Mobilní skupina Vodafone ve středu oznámila, že finanční ředitel Luka Mucic odstoupí ze své funkce na začátku příštího roku, a dodala, že hledání jeho nástupce již probíhá.

Mucic přijal nabídku na pozici generálního ředitele přední německé realitní společnosti Vonovia SE, která se v rámci snahy o zotavení z celosvětového propadu realitního trhu rozhodla vyměnit svého dlouholetého generálního ředitele.

There are no macroeconomic releases scheduled for Monday. As a result, we are likely to see a typical "quiet Monday" with low volatility and no intraday trend movement. However, we remind you that on Friday, Donald Trump announced a new round of 100% tariffs on all Chinese imports, and traders had very little time to price in this event. Therefore, today the U.S. dollar may continue to weaken.

Two fundamental events are scheduled for today:

However, it's important to keep in mind that last week Jerome Powell already addressed the market and made it clear to traders: The Fed will continue to make decisions based on macroeconomic data, and another interest rate cut is not guaranteed. Previously, Powell expressed the same rhetoric. He does not rule out two rate cuts before the end of the year, but he does not promise them either.

How the Fed will decide at the end of October—especially if the government shutdown is still in effect—remains unknown, as no key reports on inflation, unemployment, or labor market conditions have been released.

As for the ECB, there is no uncertainty whatsoever. Christine Lagarde has spoken five or six times over the past two weeks, clearly stating that any adjustments to monetary policy should not be expected in the near future.

Therefore, there is no intrigue whatsoever in today's speeches by central bank officials from either side.

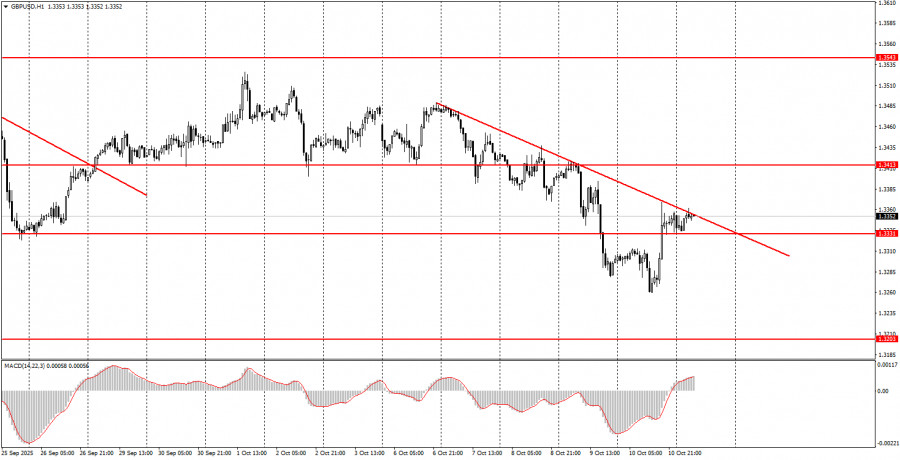

On the first trading day of the week, both currency pairs may continue to trade chaotically and illogically. So far, we have mostly seen a decline in both EUR/USD and GBP/USD, with no solid explanations. However, Trump once again steps in. Today, the euro may continue pushing higher toward 1.1655–1.1666, and the British pound toward 1.3413–1.3421.

Important speeches and economic releases (always listed in the news calendar) can significantly impact currency movement. Traders should be especially cautious or exit positions before such events to avoid sudden price reversals.

Beginner traders in the forex market must remember: not every trade will be profitable. Developing a clear strategy and applying sound money management principles are keys to long-term success in trading.

QUICK LINKS