Following the results of the Fed meeting, J. Powell actually announced when the first increase in interest rates should be expected, and it can be recalled it will be in March. Now, the main topic is the pace at which this process will take place.

If not all, much depends on how actively the Fed will raise interest rates. If they increase by 0.25% of the announced four times, then it is easy to calculate that the interest rate range will increase from only 1.00% to 1.25% by the end of 2022, just like in 2004. At that time, the DOW hovered around the 10500.00 mark and the S&P 500 hovered around the 1125.00 mark. Meanwhile, the dollar index moved in the range from 80.65 to 92.45 points. The yield of the benchmark 10-year Treasuries was approximately at the level of 3.9% to 4.00%.

Relying on historical data, we should expect such figures again, at least according to the ICE dollar index and the yield of 10-year treasuries. But a reasonable question arises – will the US stock indexes drop to these marks? Following the logic of historical calculations, the DOW should collapse three times, and the S&P 500 should collapse twice. But, as the same story shows, this will not happen. There are at least two reasons for this. First is the temporary devaluation of the US dollar and investor preferences. If everything is clear with the first one, since historically any currency is gradually devalued, we do not take the upheaval factor. The second one is explained by the attractiveness of the stock market. Other than that, everything is fine in the US.

This means that with the process of raising the Fed's interest rates in the future, it will be possible to observe an increase in the dollar index, which will occur until the Central Banks of other economically developed countries begin their cycles of raising rates and balance the US dollar. In the short term, the ICE index has every chance to rise to 100 points.

A similar picture awaits the yield of Treasuries, which will only pull up and contribute to the strengthening of the US currency.

On another note, what's doubtful is the prospects for a noticeable decline in stock indices. They face a difficult future, but not a very hard one. Everything will depend on how much the Fed raises rates in March. If only by 0.25%, then the correction that has already taken place probably already considers this level of increase. This means that it will end not today or tomorrow and it will be possible to observe their upward pullback. Incidentally, the same is expected for the US dollar. A further deeper fall in both stock indices and the growth of the dollar should be expected only in case of simultaneous rate hikes immediately by 0.50%, but this will happen only if strong inflation continues.

In the meantime, Fed funds rates are expected to increase in March by 0.25% according to the dynamics of futures. Therefore, the data for January, and then for February, will be decisive for how much the regulator will raise rates – by 0.25% or immediately by 0.50%. In the near future, there is a high probability of a downward correction on the US dollar against major currencies, an increase in demand for company shares and commodity assets, and a consolidation of US Treasury yields near the reached levels.

Forecast of the day:

The EUR/USD pair declined to the support level of 1.1135. A change in the market mood will lead to the pair's attempt to rise to 1.1200.

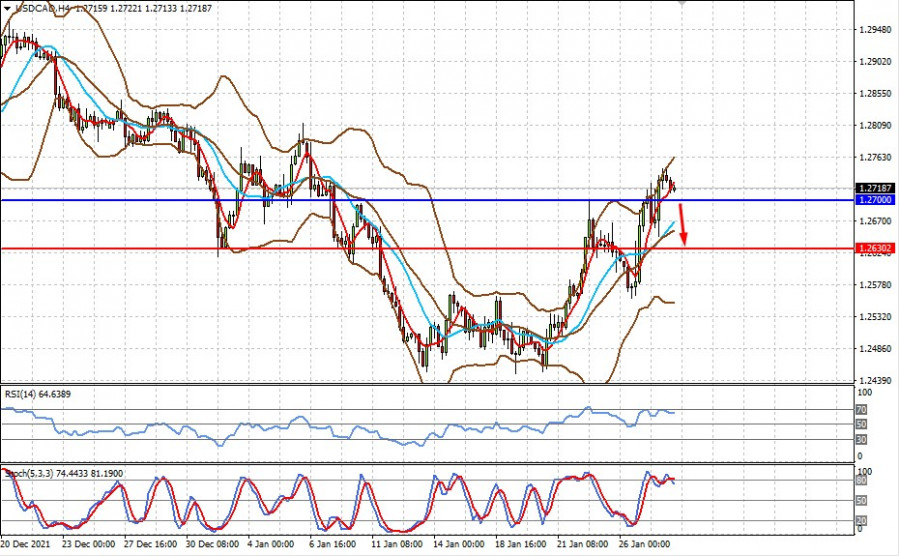

The USD/CAD pair is trading above the level of 1.2700. The continuous growth in crude oil prices and the correction of the US dollar may lead to the pair's decline to the level of 1.2630.

QUICK LINKS