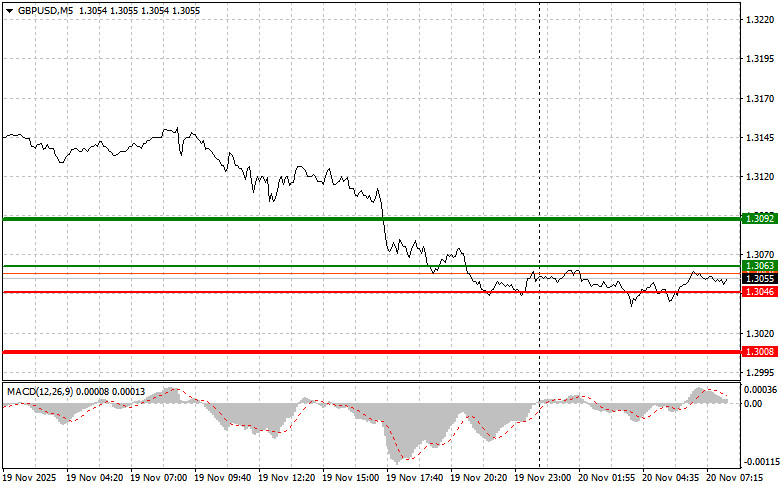

The test of the price at 1.3103 occurred when the MACD indicator had moved significantly below the zero mark, limiting the pair's bearish potential. The second test at 1.3103 coincided with the MACD being in the oversold area, prompting trade #2 to buy the pound, which resulted in a loss as the anticipated rise did not materialize.

The appreciation of the dollar and the decline of the pound came after it became clear that many Federal Reserve officials consider it prudent to keep interest rates unchanged until the end of 2025. The minutes strengthened the dollar's position against other major currencies, as investors revised their expectations for the timing and scale of future interest rate cuts in the U.S. Earlier, the market had expected a more aggressive easing of monetary policy by the end of the year. However, now, given the Fed's more conservative stance, confidence is growing that the dollar will retain its appeal as a relatively high-yielding currency.

Today, the only economic report will be the CBI Industrial Order Balance from the Confederation of British Industry. The market will certainly focus on the CBI report as the only source of an up-to-date view of the state of British industry. Experts predict a slight improvement in this indicator, which could lead to a temporary recovery of the pound, but it is unlikely to have a significant impact on the current bearish market. Other factors, such as news on the budget from Rachel Reeves, may have a more significant impact on the pound's exchange rate.

Regarding intraday strategies, I will mainly rely on implementing scenarios #1 and #2.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.

RYCHLÉ ODKAZY