Forex is a place where questions never end. In the first phase of monetary tightening, investors worry about how quickly rates will rise. Then, how high they will grow. Finally, at the finish line, how long they will remain at the peak. The fact that the current cycle of the Fed's monetary restriction has come to an end is evidenced by the first in many months that the real cost of borrowing has entered the positive area. The personal consumption expenditures index slowed to 3.9% in the fourth quarter, below the current federal funds rate of 4.5%.

Dynamics of the Fed's real rate

Thus, monetary policy is no longer neutral but contractionary. One wrong move by the Fed and the soft landing of the U.S. economy can be forgotten. The central bank believes that there are only two such steps left: 25 bps each in February and March. After that, it will be possible to sit on the sidelines and observe how the monetary restriction cycle affects GDP. How long will this contemplation of reality last? The Nordea study claims that only once since the 1970s has the federal funds rate been at its peak for more than a year. On average, it was there for a little over five months.

In Europe, a different picture took place. The ECB's predecessor, the Bundesbank, started cutting borrowing costs an average of 9 months after the last increase. And it looks logical. The American labor market and the economy as a whole are more dynamic than their European counterparts. They react faster to changing factors, adapt faster to the new reality. It has always been so. Therefore, inflation in the euro area is likely to remain at elevated levels for longer than in the U.S. And the ECB, accordingly, will keep the deposit rate at its peak longer than the Fed.

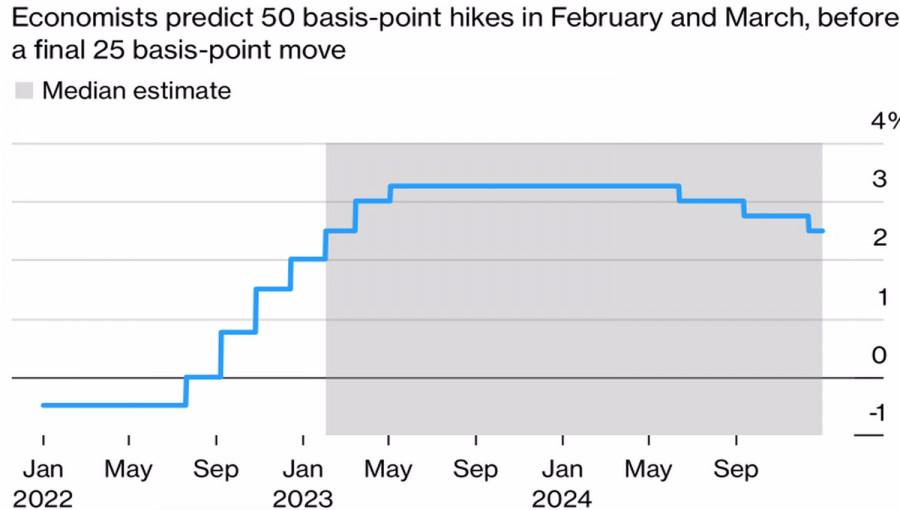

According to Bloomberg experts, it will grow by 50 bps in February, and reach a ceiling of 3.25% by the middle of the year. After that, the cost of borrowing will remain there for the next 12 months.

ECB deposit rate forecasts

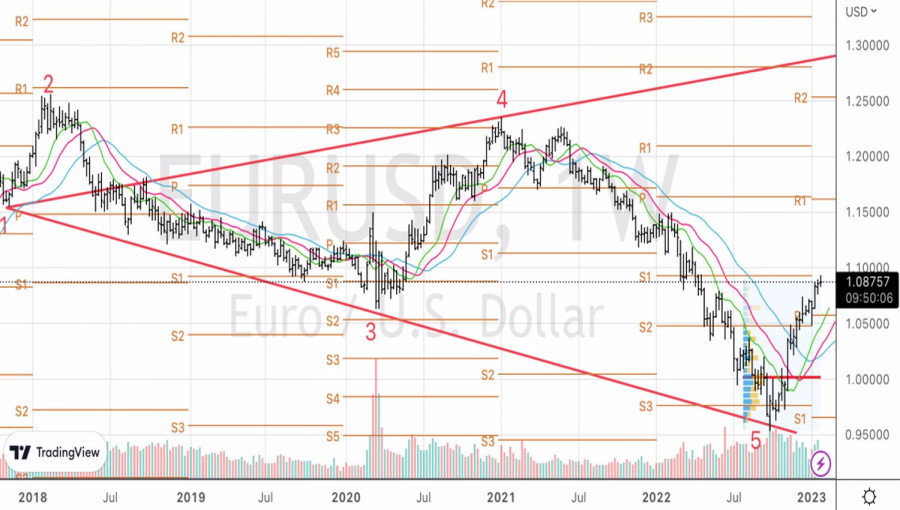

It is possible that the markets are wrong in thinking that the Fed will cut the federal funds rate from 5% to 4.25%–4.5% as early as 2023, but the fact that the rate differential will decrease until mid-2024 plays on the side of EURUSD bulls. This circumstance creates a solid foundation for the continuation of the rally of the main currency pair in the direction of 1.15 this year and up to 1.2–1.25 in the next.

Corrections to the upward trend will certainly happen. How could they not? For example, an unexpectedly hawkish Fed rhetoric following the FOMC meeting from January 30 to February 1, or an insufficiently hawkish speech by Christine Lagarde a day later, risk dropping the euro below $1.08 or even $1.07. However, these pullbacks will be an ideal buying opportunity.

Technically, the implementation of the Wolfe Wave pattern continues on the EURUSD weekly chart. Bulls stopped the 1.0925 pivot point. However, its successful assault will allow the euro to continue its rally towards 1.1135 and 1.1215.