Only the euro was traded today using the Mean Reversion scenario, although even there no strong reversal movement occurred. I did not trade anything using the Momentum approach.

Inflation data in the eurozone for November matched economists' forecasts, which resulted in very low market volatility in EUR/USD. However, the unemployment rate came in slightly above expectations. This confirms that the European Central Bank still has no strong reasons to change its accommodative monetary policy. Consumer prices in the eurozone rose by 2.1% year-on-year, in line with expectations and not significantly deviating from the ECB's target.

The British pound showed a small spike in volatility following news that UK housing prices rose for the third consecutive month. The average house price increased by 0.3% in November, slightly higher than the 0.1% rise in October.

Later today, only a speech by FOMC member Michelle Bowman is expected, who is unlikely to address monetary policy, along with the RCM/TIPP U.S. Economic Optimism Index. Markets will certainly pay attention to every word from the Federal Reserve representative, but given the preliminary agenda, significant fluctuations in financial markets are not expected. Bowman's speech will most likely focus on broader economic topics and possibly financial stability rather than specific details on future monetary policy actions. The RCM/TIPP Economic Optimism Index, meanwhile, will provide some insight into consumer and investor sentiment in the U.S. Data exceeding expectations could offer short-term support to the U.S. dollar by reflecting increased confidence in economic growth.

If the statistics turn out strong, I will rely on implementing the Momentum strategy. If there is no market reaction to the data, I will continue using the Mean Reversion strategy.

Momentum Strategy (breakout trades) for the second half of the day:

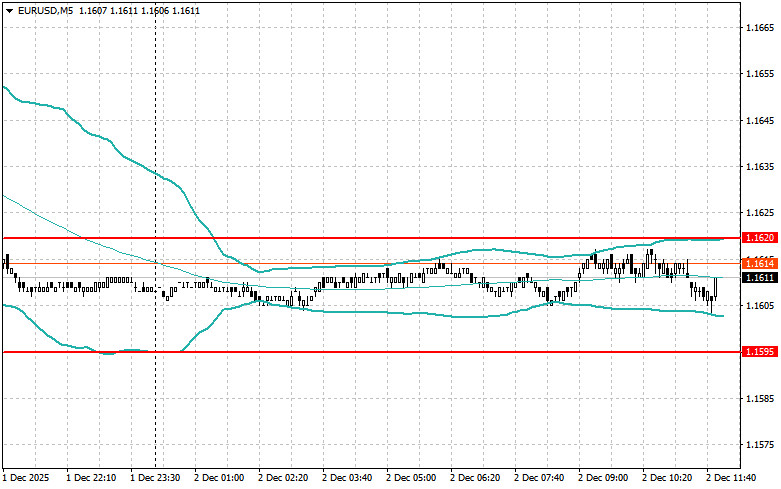

For EUR/USD

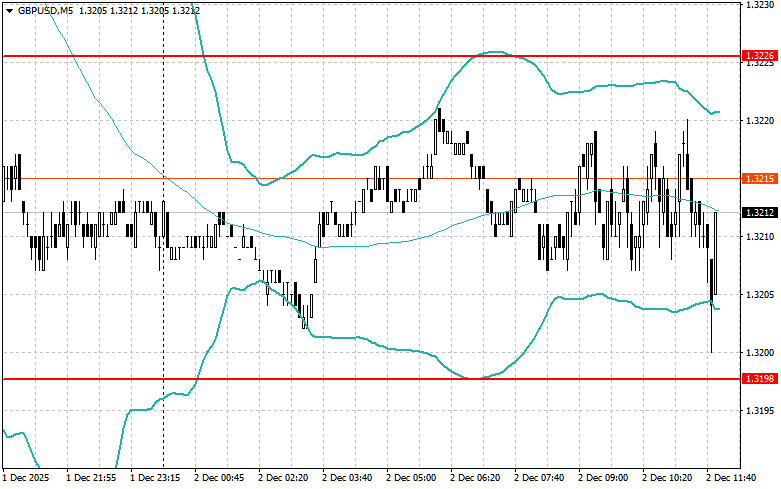

For GBP/USD

For USD/JPY

Mean Reversion Strategy (reversion trades) for the second half of the day:

For EUR/USD

For GBP/USD

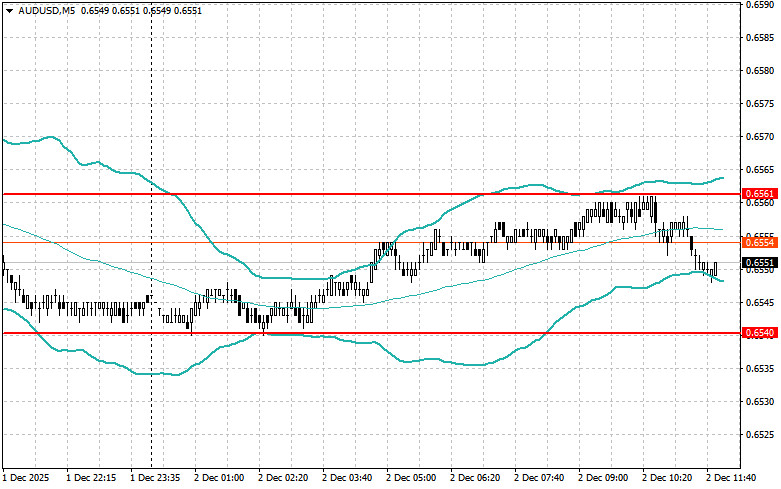

For AUD/USD

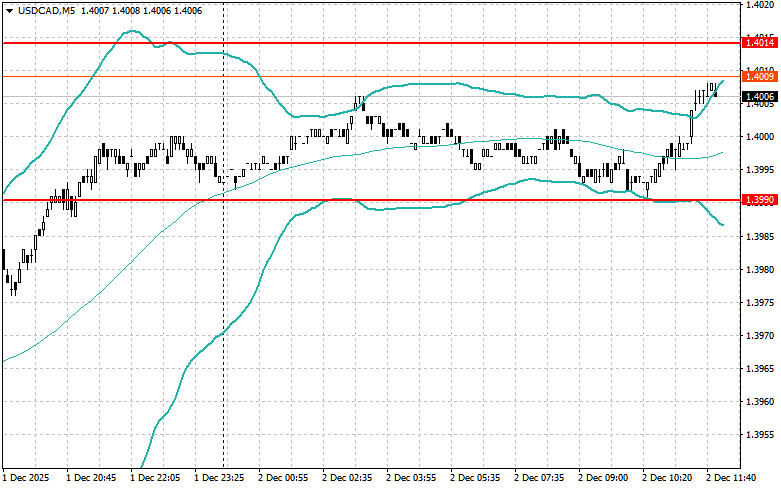

For USD/CAD