On Tuesday, the EUR/USD pair continued a weak downward movement and consolidated below the 61.8% retracement level at 1.1594. Thus, the decline in quotes may continue toward the next 76.4% Fibonacci level at 1.1517. A consolidation of the pair above 1.1594 would work in favor of the euro and a resumption of growth toward the resistance zone of 1.1645–1.1656.

The wave situation on the hourly chart remains simple and clear. The last upward wave did not break the peak of the previous wave, while the last completed downward wave broke the previous low. Thus, the trend remains "bearish." Bullish traders have moved into offense, but they must maintain momentum for the "bullish" trend to resume. For the "bearish" trend to be considered complete, the pair needs to rise above 1.1656 or form two consecutive "bullish" waves.

There was no fundamental background on Tuesday, but recently the market has heard many comments from FOMC members indicating that monetary policy parameters are likely to remain unchanged in December. This information could have supported the bears, but note that we are talking not about further tightening of the Fed's policy, but about refusing additional easing. Thus, the dollar has no solid reason to react with growth to a decision that the Fed has not even made yet. This evening, the minutes of the previous FOMC meeting will be released, and it is clear that "hawkish" tones will be present. However, over the past three weeks—during which the FOMC repeatedly signaled its desire to keep policy unchanged in December—traders have had more than enough time to factor this in. Therefore, I believe the evening minutes will not provide support for the U.S. dollar. There will be very few other events throughout the day, and their significance for the market is low. Thus, only chart analysis will allow traders to open trades today.

On the 4-hour chart, the pair bounced from the 23.6% retracement level at 1.1649, reversed in favor of the U.S. dollar, and began a new decline toward the 38.2% Fibonacci level at 1.1538. A consolidation above the resistance zone of 1.1649–1.1680 will work in favor of the euro and continuation of growth toward the next correction level at 1.1829. No forming divergences are seen today on any indicators.

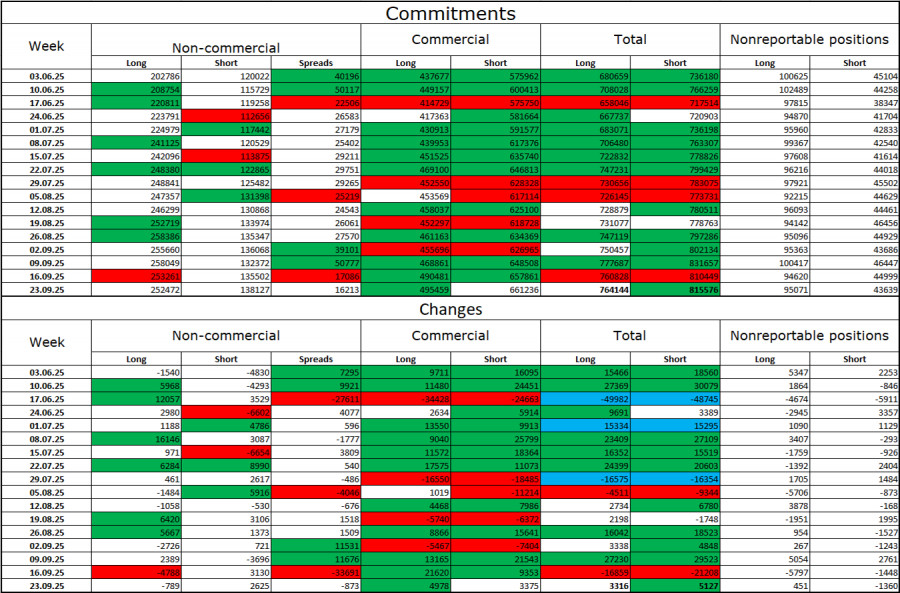

Commitments of Traders (COT) Report:

Over the last reporting week, professional traders closed 789 long positions and opened 2,625 short positions. No new COT reports have been released for more than a month. The sentiment of the "Non-commercial" group remains "bullish" thanks to Donald Trump and continues strengthening over time. The total number of long positions held by speculators is now 252,000, while shorts total 138,000. The gap is practically twofold. In addition, note the number of green cells in the table above—they show strong accumulation of positions in the euro. In most cases, interest in the euro continues to grow, while interest in the dollar declines.

For 33 consecutive weeks, large players have been reducing short positions and increasing long ones. Donald Trump's policies remain the most significant factor for traders, as they may cause many problems of long-term and structural nature for the U.S. Despite the signing of several important trade agreements, many key economic indicators continue to decline.

News Calendar for the U.S. and the EU:

On November 19, the economic calendar includes two entries, only one of which can be considered conditionally important. The influence of the news background on market sentiment on Wednesday may be very weak or nonexistent.

EUR/USD Forecast and Trader Recommendations:

Sales of the pair were possible after a rebound from the 1.1645–1.1656 level on the hourly chart with a target of 1.1594. The target has been reached. New sales are possible if the pair closes below 1.1594 with a target of 1.1517. Purchases may be considered if the pair consolidates above 1.1594 on the hourly chart with a target of 1.1645–1.1656.

The Fibonacci grids are built using 1.1392–1.1919 on the hourly chart and 1.1066–1.1829 on the 4-hour chart.