Velká Británie zakoupí letadla Boeing (NYSE:BA) v hodnotě 10 miliard dolarů, uvedl ve čtvrtek americký ministr obchodu Howard Lutnick při oznámení bilaterální obchodní dohody mezi Velkou Británií a Spojenými státy, podrobnosti však nebyly uvedeny.

Taková objednávka by se přidala k již tak velkému počtu letadel Boeing určených pro britské zákazníky – podle zveřejněných údajů společnosti Boeing jich je celkem 149.

Lutnick naznačil, že se jedná o nákup ze soukromého sektoru, a uvedl, že podrobnosti oznámí letecká společnost, která jej realizuje. Grafika Bílého domu s obecnými podmínkami dohody hovoří o nákupu „leteckých dílů“ v hodnotě 10 miliard dolarů, bez dalších podrobností.

Není jasné, o jaký typ letadel se jedná a zda dohoda zahrnuje pevné objednávky nebo opce. Boeing se k věci odmítl vyjádřit.

British Airways podle zdroje obeznámeného s touto záležitostí jedná o koupi dalších širokotrupých letadel, buď Airbus A350, nebo Boeing 787, které již provozuje.

Podle webových stránek společnosti Boeing zahrnuje nevyřízené objednávky ve Velké Británii 109 letadel od leteckých společností a 40 letadel pro leasingovou společnost. Na základě objednaných modelů mají britské společnosti u společnosti Boeing objednávky letadel v odhadované hodnotě přes 12 miliard dolarů.

Výrobci letadel se potýkají s problémy v dodavatelském řetězci a dalšími výzvami, které zpožďují dodávky. Boeing se snaží zvýšit výrobu svého nejprodávanějšího letadla 737 MAX na 38 kusů měsíčně v letošním roce, poté co v roce 2024 čelil obtížné situaci, kdy výroba poklesla v důsledku rozsáhlé krize kvality, která vedla k výměně generálního ředitele.

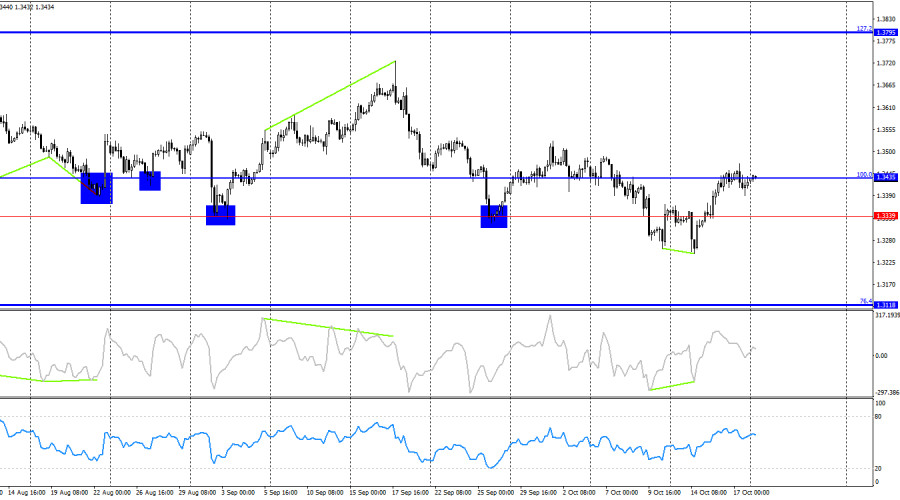

On the hourly chart, the GBP/USD pair on Friday rebounded from the 76.4% Fibonacci retracement level at 1.3460 (red dashed line), reversed in favor of the U.S. dollar, and fell toward the 50.0% Fibonacci level at 1.3387, according to the updated Fibonacci grid. A rebound from 1.3387 worked in favor of the British pound, leading to renewed growth toward 1.3460. Today, another rebound from this level may again allow traders to expect a slight decline in quotes, while a consolidation above it will increase the likelihood of continued growth toward the next corrective level of 100.0% (1.3526).

The wave pattern has shifted to a bullish configuration almost in a single day. The last completed downward wave broke the previous low, but the latest upward wave also broke the previous peak. The news background in recent weeks has been negative for the U.S. dollar, yet bullish traders have not taken advantage of this to push higher. Now they are starting to spread their wings.

On Friday, there was no significant news from either the UK or the U.S., but this week several reports are expected that deserve attention. The most important of these is the U.S. Consumer Price Index (CPI), which continues to influence the FOMC's monetary policy. In recent months, inflation in the U.S. has been rising, which may restrain the Federal Reserve's dovish impulses. At the same time, there is no new data on the labor market or unemployment. The FOMC is already set on continuing its monetary easing, so inflation is unlikely to affect decisions before the end of the year — but it may play a bigger role later on.

Today, Monday, there will be no significant news background, so trading will have to rely solely on graphical analysis. In my view, pressure on the dollar will persist, as the U.S. government shutdown situation remains unresolved, and the U.S.–China conflict continues. The negotiations scheduled for November may not take place or may end without results. China is not willing to blindly follow Trump's ultimatums, so I believe a new escalation of the trade war is more likely than a trade deal.

On the 4-hour chart, the pair turned in favor of the British pound after forming a bullish divergence on the CCI indicator and rose toward the 100.0% Fibonacci retracement level at 1.3435. A rebound from this level would allow traders to expect a reversal in favor of the U.S. dollar and a moderate decline toward 1.3339. A consolidation above this level will increase the probability of continued growth toward the next 127.2% Fibonacci level at 1.3795. No new divergences are currently observed on any indicators.

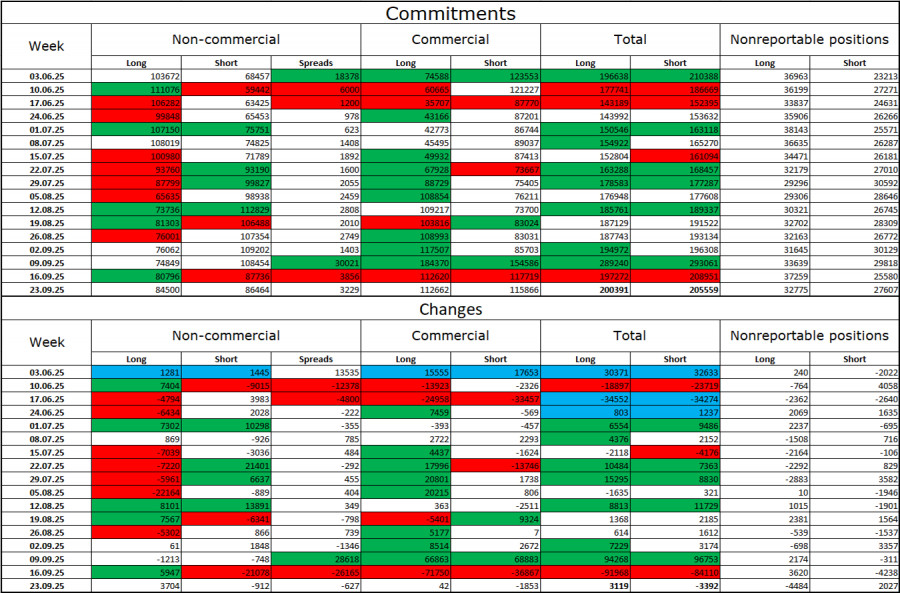

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category became more bullish during the last reporting week. The number of long positions held by speculators increased by 3,704, while the number of short positions decreased by 912. The gap between longs and shorts now stands at approximately 85,000 vs. 86,000, showing that bullish traders are once again tipping the scales in their favor.

In my opinion, the British pound still faces some downside potential, but with each passing month, the U.S. dollar looks weaker and weaker. Previously, traders were worried about Donald Trump's protectionist policies, unsure of their long-term impact. Now, however, they are beginning to fear the consequences of those policies: a possible recession, the constant introduction of new tariffs, and Trump's conflict with the Federal Reserve, which could make the regulator politically dependent on the White House. Thus, the British pound now appears far less vulnerable than the U.S. currency.

Economic Calendar for the U.S. and the U.K.:

October 20: The economic calendar contains no significant events. The information background will not influence market sentiment on Monday.

Forecast for GBP/USD and Trading Recommendations:

Sell positions: Possible after a rebound from 1.3460 on the hourly chart, targeting 1.3419–1.3425 and 1.3387. Buy positions: Could be considered after a rebound from 1.3387, or after closing above the 1.3419–1.3425 zone, with a target at 1.3460. A consolidation above 1.3460 will allow traders to hold long positions with a target at 1.3526.

Fibonacci grids are built as follows: