Analysts say that Bitcoin and Ethereum will have to watch out for more volatility despite some lull. The long-term prospects for cryptocurrencies continue to be positive.

The price action of cryptocurrencies is still closely linked to US stocks, which are still under pressure due to the Fed's hawkish statement.

According to OANDA Senior Market Analyst Edward Moya, Bitcoin's fluctuating dynamics is not over yet since the Fed intends to conduct a more aggressive monetary policy this year. Perhaps, the next few months will be filled with volatile crypto asset trading.

On Wednesday, Fed Chairman Jerome Powell noted that the situation with American inflation is now slightly worse than in December.

GlobalBlock's analyst, Marcus Sotiriou, said that this macro trigger for Bitcoin is currently at the forefront of the cryptocurrency market. In addition, the recent sell-off was caused partially by macroeconomic conditions.

Marcus Sotiriou noted that cryptocurrencies and stocks will struggle over the next month or two until the next Fed meeting on monetary policy, which will be held in March.

According to him, trading will be a bit difficult. Institutions will try to protect themselves from a rate hike in March, which is still unknown whether this will be a double rate hike or not. But as soon as people realize that raising rates will not change everything, the upward trend may resume in the cryptocurrency market. The long-term prospect is still very optimistic.

On the other hand, Tokens.com CEO Andrew Kiguel said that high volatility is nothing new to the crypto space. He believes that cryptocurrencies will have another good year. People forget that Bitcoin almost doubled its value last year, where the recorded growth was 60%.

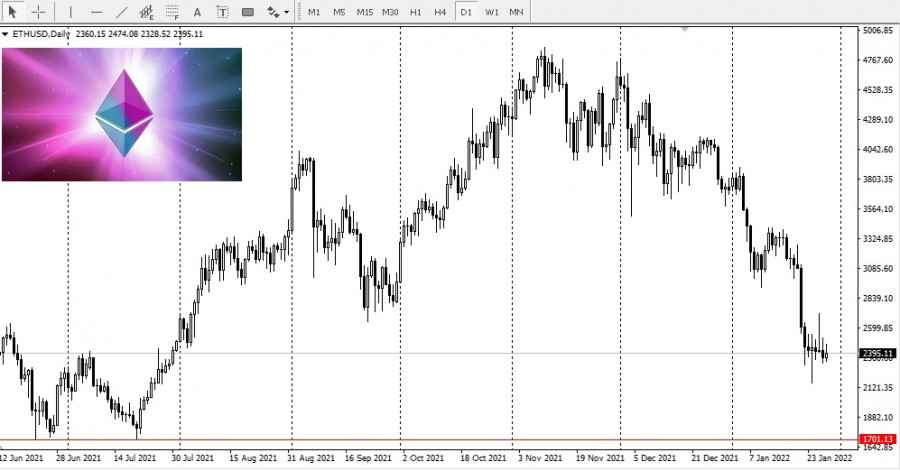

Ethereum gained even more.

Andrew Kiguel also noted the split between the price of Bitcoin and the prices of other Web3-related crypto assets such as Ethereum.

"There will be more separation between Bitcoin and Web3 assets. The main catalyst for Bitcoin will be regulation on the mining front and if the SEC allows real spot Bitcoin ETF. Ethereum will build on Web3 developments, including crypto gaming and DeFi," Kiguel said.

He also added that Ethereum could outperform Bitcoin again in 2022. This year, Bitcoin is expected to rise from $80,000 to $100,000, while Ethereum could rise another 400% compared to current levels.

Most likely, Bitcoin will end the year up 40-50% higher than it was in 2021. In turn, Ethereum will have much more potential to grow.

In addition, the inflation narrative will continue to support bitcoin throughout the year as retail investors and institutions look for assets that can be used as a hedge against rising price pressures.

And since US inflation is at its highest in four decades, the Bitcoin case will resonate with even more investors.

Bitcoin is still in the adoption stage. It was created as a method to save money in a decentralized way. The price is volatile in the short term, but if people had been using Bitcoin as a saving account for the last decade, or even the last few years, they would certainly be richer today than in the past.

ĐƯỜNG DẪN NHANH