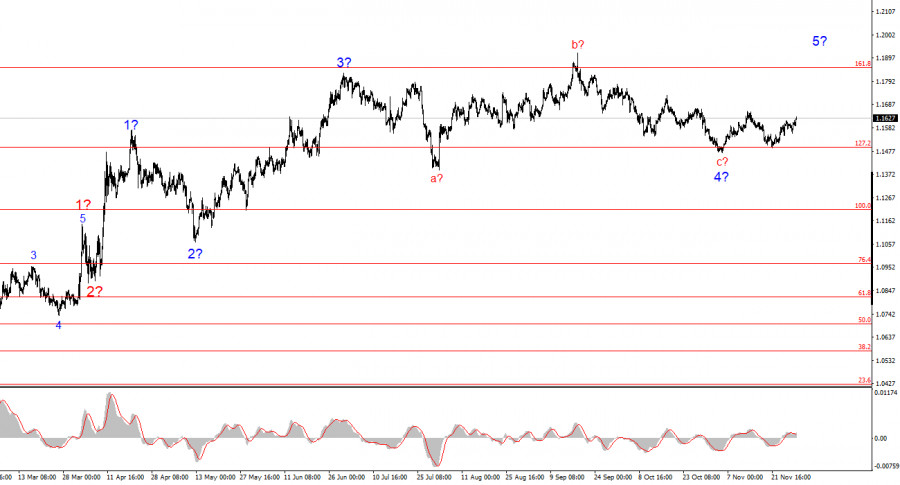

The wave pattern on the EUR/USD 4-hour chart has changed, but overall it remains fairly clear. There is no talk of cancelling the upward trend segment that began in January 2025, but the wave structure since July 1 has become significantly more complex and extended. In my view, the instrument has completed the formation of corrective wave 4, which took a very unconventional form. Inside this wave, we observe exclusively corrective structures, so there is no doubt about the corrective nature of the decline.

In my opinion, the formation of the upward trend segment is not finished, and its targets extend all the way to the 1.25 level. The sequence of waves a–b–c–d–e appears complete; therefore, in the coming weeks I expect the development of a new upward set of waves. We have already seen the presumed waves 1 and 2, and the instrument is now in the process of forming wave 3 or c. I expected the second wave to end within the 38.2%–61.8% Fibonacci retracement level of wave 1, but prices fell to 76.4%. Over the past several days, everything has been unfolding according to plan.

EUR/USD added about 35 basis points by early US trading on Monday, but something else is more important. Demand for the euro is rising—which fully corresponds to the current wave pattern—but today in the first half of the day the news background was extremely weak and not supportive of the European currency. Therefore, the euro is rising on market enthusiasm. Let me remind you that over the past two months I repeatedly asked: why is the market buying the dollar? Those purchases could not be described as large or aggressive, yet the US currency kept rising steadily, ignoring the Fed's monetary easing, the government shutdown, and Donald Trump's tariffs. So in some sense, the US dollar over-fulfilled its corrective plan.

Now we are seeing the opposite situation. Demand is rising for the euro, which I consider completely logical, since the news background for the dollar remains extremely negative, while the wave pattern—both global and local—continues to indicate the formation of an upward wave sequence. I cannot say with certainty that the corrective structure that took several months to form is fully complete, but the presumed wave 5 must begin forming at some point. Why not now? However, the instrument must first, within wave 3, break above the peak of the presumed wave 1. The intensity of the current rise does not yet allow us to describe it as an impulsive wave formation. Therefore, new corrective structures are possible.

Based on my EUR/USD analysis, I conclude that the instrument continues forming an upward trend segment. Over the past few months, the market took a pause, but Donald Trump's policies and the Fed remain strong long-term factors that may push the US dollar lower in the future. The targets of the current trend segment may extend all the way to the 1.25 level. At this time, the upward wave sequence may continue developing. I expect the formation of the third wave of this sequence—either wave c or wave 3—to continue from current levels, with target ranges between 1.1670 and 1.1720.

On the lower time frame, the entire upward trend segment is visible. The wave pattern is not textbook-perfect, since the corrective waves differ in size. For example, the higher-degree wave 2 is smaller than the internal wave 2 in wave 3. But such cases do occur. Let me remind you: it is better to isolate clear structures on the chart rather than try to label every single wave. At the moment, the bullish structure raises no doubts.

Key principles of my analysis:

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2025-12-02 03:17:37 IP: 216.73.216.19