The U.S. dollar initially lost ground against risk assets but quickly regained its position after Fed Chair Jerome Powell's speech.

Yesterday, the Federal Reserve cut interest rates by a quarter point. At first, the euro and the pound reacted with gains, but without clear hints from Powell on further aggressive rate cuts this year, the dollar sharply rebounded. The market had expected a stronger signal confirming the Fed's readiness to ease monetary policy.

The lack of firm commitments disappointed traders who had counted on more aggressive measures to stimulate the economy. Uncertainty about the Fed's next steps pushed investors toward the dollar, traditionally seen as a safer asset in times of economic instability. Going forward, much will depend on the upcoming macroeconomic data. If inflation growth remains under control while the pace of economic expansion slows, the Fed may be forced to revisit the issue of additional rate cuts. Otherwise, maintaining current levels could become the central bank's priority.

Today, the ECB's current account balance data and a speech by ECB President Christine Lagarde are expected. Traders will scrutinize any hints of a policy shift, though it is possible Lagarde will avoid the topic altogether. Overall, short-term prospects for the euro remain uncertain. For sustainable growth, the single currency will require supportive macroeconomic data and clear signals from the ECB on economic support. Without this, pressure on the euro may persist.

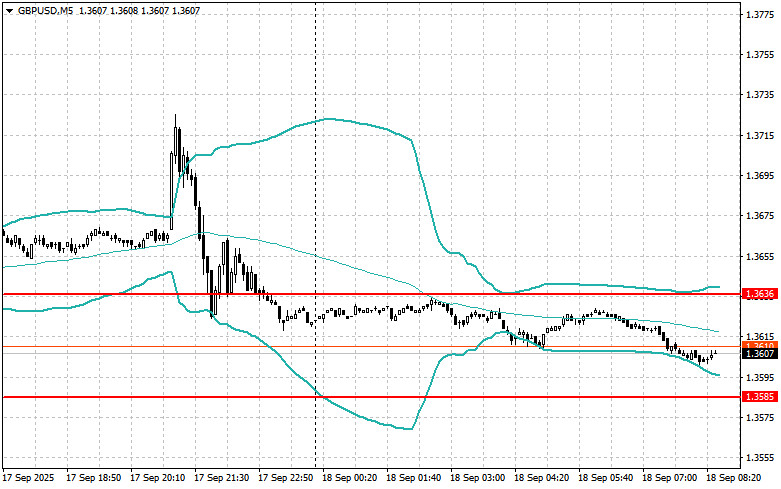

As for the pound, the Bank of England will announce its key rate decision and release its monetary policy summary in the first half of the day. The British currency remains under pressure from concerns over the country's economic outlook. Inflation continues to rise above the target level, while growth momentum remains weak. Most economists expect the central bank to keep rates unchanged today.

However, any hints at potential monetary easing could trigger a short-term sell-off in sterling.

If the data matches economists' expectations, the Mean Reversion strategy is preferable. If the figures deviate significantly from forecasts, the Momentum strategy should be applied.

Buy on a breakout above 1.1805, targets 1.1830 and 1.1870.

Sell on a breakout below 1.1780, targets 1.1750 and 1.1725.

Buy on a breakout above 1.3612, targets 1.3635 and 1.3667.

Sell on a breakout below 1.3585, targets 1.3555 and 1.3525.

Buy on a breakout above 147.45, targets 147.72 and 148.03.

Sell on a breakout below 147.25, targets 147.00 and 146.70.

Look for selling opportunities after a failed breakout above 1.1833 and return below this level.

Look for buying opportunities after a failed breakout below 1.1780 and return above this level.

Look for selling opportunities after a failed breakout above 1.3636 and return below this level.

Look for buying opportunities after a failed breakout below 1.3585 and return above this level.

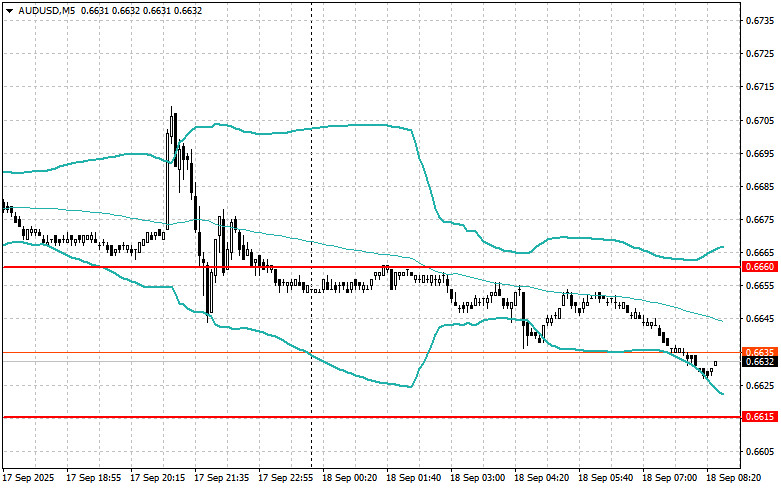

Look for selling opportunities after a failed breakout above 0.6660 and return below this level.

Look for buying opportunities after a failed breakout below 0.6615 and return above this level.

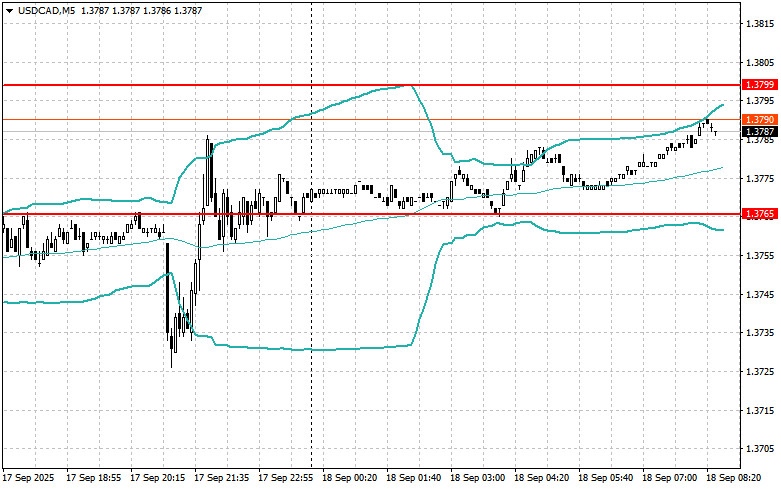

Look for selling opportunities after a failed breakout above 1.3799 and return below this level.

Look for buying opportunities after a failed breakout below 1.3765 and return above this level.

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2025-09-18 04:18:56 IP: 216.73.216.187