Těžba ropy z břidlic v USA se ustálí, pokud ceny zůstanou na současné úrovni, a začne klesat při cenách ropy na úrovni 50 dolarů za barel, uvedl v úterý generální ředitel společnosti ConocoPhillips (NYSE:COP) Ryan Lance.

„Zlomová hranice se pravděpodobně příliš nepohnula. Myslím si, že z dlouhodobého hlediska, pokud se řekne ceny ropy v pohodlném rozmezí – možná v 70 nebo 65-75 bodech, budeme stále svědky pokračujícího mírného růstu z USA,“ dodal Lance, který vystoupil na Katarském ekonomickém fóru v Dauhá.

„Ale vidíme, že produkce z USA se pravděpodobně do konce tohoto desetiletí zastaví, pokud v našem oboru nedojde k dalšímu technologickému průlomu. A nesázejte proti našemu průmyslu.“

Pokud by cena ropy klesla pod 60 dolarů za barel, došlo by k poklesu investic a celosvětové energetické požadavky by nebyly uspokojeny, uvedl katarský ministr energetiky Saad al-Kaabi, který na stejné akci vystoupil spolu s Lancem.

Dodal, že Katar, který je jedním z největších světových vývozců zkapalněného zemního plynu (LNG), se „vůbec neobává“ přebytku dodávek zkapalněného zemního plynu (LNG).

There are relatively few macroeconomic reports scheduled for Monday. In the Eurozone, consumer price indices and unemployment rates will be released. These are important reports, but only unexpected and significant figures can provoke a reaction from traders. The European Central Bank has concluded its easing cycle with a 99% probability, so only a strong increase or decrease in inflation could prompt it to reconsider its rate plans. In the UK and the U.S., the calendars are practically empty.

Very few fundamental events are planned for Tuesday. Overnight, there was an expected speech from Federal Reserve Chair Jerome Powell, but as of now, there is no information about it, and market movements suggest Powell likely did not convey anything significant. Recall that the Fed meeting is scheduled for December 10, and currently, there is no vital information regarding inflation, the labor market, or unemployment. It is uncertain whether any pertinent information will arrive before December 10. Additionally, a speech from FOMC member Michelle Bowman, who has recently supported accommodative monetary policy, is expected.

Overall, the market is anticipating a third rate cut in 2025, but whether the Fed will take such a risk in the absence of labor-market and unemployment data is unclear.

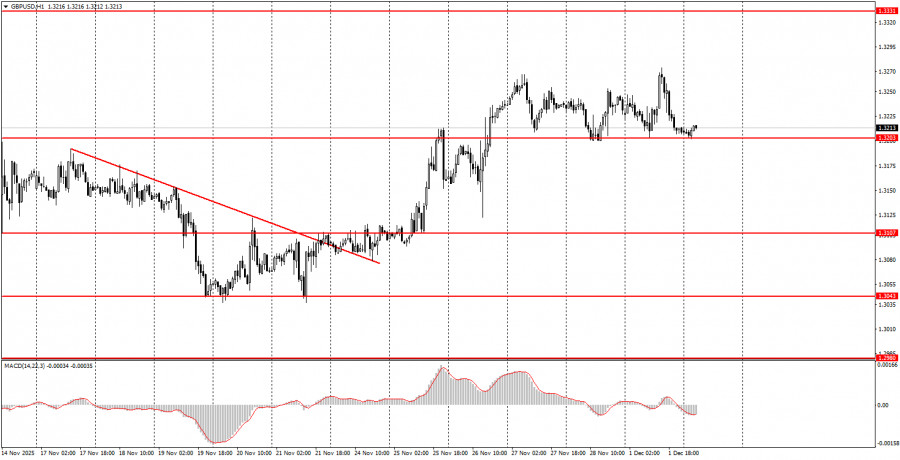

During the second trading day of the week, both currency pairs will trend toward growth, as a rising trend has begun in both cases. The euro has an excellent trading range at 1.1571-1.1584, where several buy signals have formed recently. The British pound has a range of 1.3203-1.3211 and is in a flat pattern. Volatility on Tuesday may remain low.

Important Note: Significant speeches and reports (always included in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their release, it is advisable to trade cautiously or exit the market to avoid sharp reversals against the preceding movement.

Remember: For beginners trading in the Forex market, it is crucial to understand that not every trade can be profitable. Developing a clear strategy and implementing sound money management are keys to successful long-term trading.

RÁPIDOS ENLACES