For decades, the American dollar has been considered a reliable asset because the U.S. has consistently met its obligations. However, as debts accumulate, the cost of servicing them is rising. Interest payment costs exceed defense spending and account for about 17% of the budget. Meanwhile, the CBO forecasts that the national debt will increase to 129% of GDP by 2034. As a result, investors are accumulating doubts about whether the greenback can continue to serve as a safe-haven asset.

Increasing taxes is an unpopular measure. The only acceptable option to cut budget expenses is to lower the federal funds rate. If it drops to the 1% target Donald Trump has set, the cost of servicing debt will decrease significantly. It's no surprise that the occupant of the White House is increasing the number of his puppets on the FOMC. Initially, it was Stephen Moore who voted for a 50-basis-point cut in borrowing costs at every Committee meeting. Now, the focus is likely to shift to Kevin Hassett.

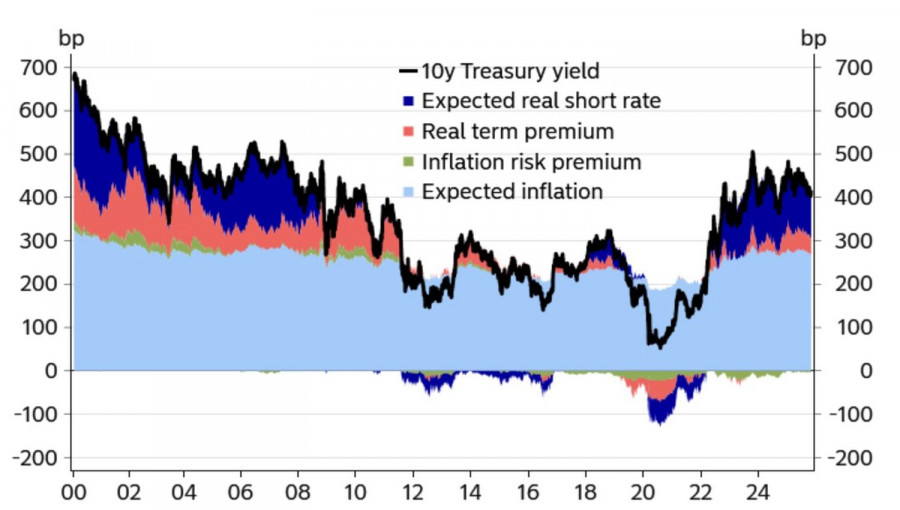

In theory, lowering the federal funds rate lowers the yield on U.S. Treasury bonds and reduces the budgetary cost of servicing debt. However, aggressive Fed monetary easing will raise serious concerns about inflation ramping up. This will result in investors offloading treasuries and raising their yields. Donald Trump's ambitious plan is unlikely to come to fruition. However, he does not know it yet.

The U.S. president's plans to lower the federal funds rate are well known and are putting pressure on the dollar amid the increased probability of continued Fed monetary expansion, now at 88% for December. The futures market is pricing in a 21% chance of a cut in borrowing costs to 3.5% in January. If the ADP employment data disappoints, and Jerome Powell and Michelle Bowman make "dovish" remarks, this figure will rise. And with it, EUR/USD quotes will increase.

When investors begin to doubt the U.S. dollar's ability to serve as a safe-haven asset, they seek other options. A stable Europe is well-suited to these purposes. ECB President Christine Lagarde and Bundesbank President Joachim Nagel believe that rates are where they need to be and that inflation is under control. The German asserts that monetary policy is neutral. Their statements are supported by consumer prices frozen near the ECB's 2% target.

Thus, the ECB does not intend to lower rates, whereas the Fed will. This may be due to pressure from Donald Trump or a freezing labor market.

Technically, on the daily chart, EUR/USD broke below the trendline and formed a pin bar with a long lower shadow. Consequently, traders increased the long positions established from 1.1535. Target levels are set at 1.1700 and 1.1750.

RÁPIDOS ENLACES