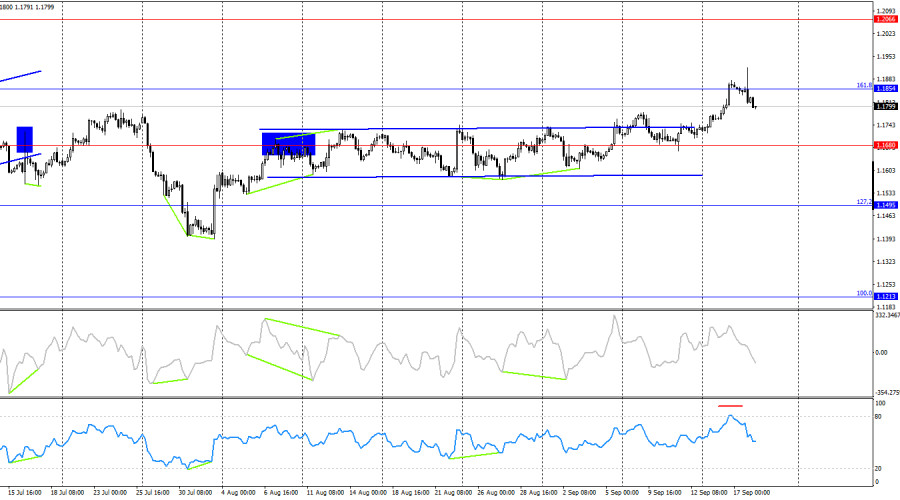

The wave structure on the hourly chart remains simple and clear. The last upward wave broke the previous peak, while the last completed downward wave did not break the previous low. Thus, the trend remains "bullish." The latest labor market data and the Fed's revised monetary policy outlook support only the bulls, leaving the bears with nothing.

On Wednesday, bulls clearly counted on Fed support, but what immediately stood out was the dollar's fall without cause on Tuesday. It can be assumed that the most dovish scenario had already been priced in by traders on Tuesday. And on Wednesday it was confirmed. Of course, each analyst and trader has their own opinion, but I believe that the signal of three rate cuts by the Fed before the end of the year is the most dovish signal possible. The dot plot showed that at the remaining two meetings, FOMC members are preparing to cut rates twice more by 0.25%. Previously, the baseline scenario was two cuts of 0.25% each. At the press conference, Jerome Powell said that the economic outlook for the next three years is uncertain, but the current state of the U.S. economy cannot be called poor. Inflation is indeed rising, but not along the worst-case trajectory.

On the 4-hour chart, the pair consolidated above the horizontal corridor, allowing traders to count on further growth. The rebound from the 161.8% Fibonacci level at 1.1854 worked in favor of the U.S. dollar, sending the pair somewhat lower toward 1.1680. Consolidation above 1.1854 would allow traders to expect renewed growth toward 1.2066. No divergences are forming on indicators today.

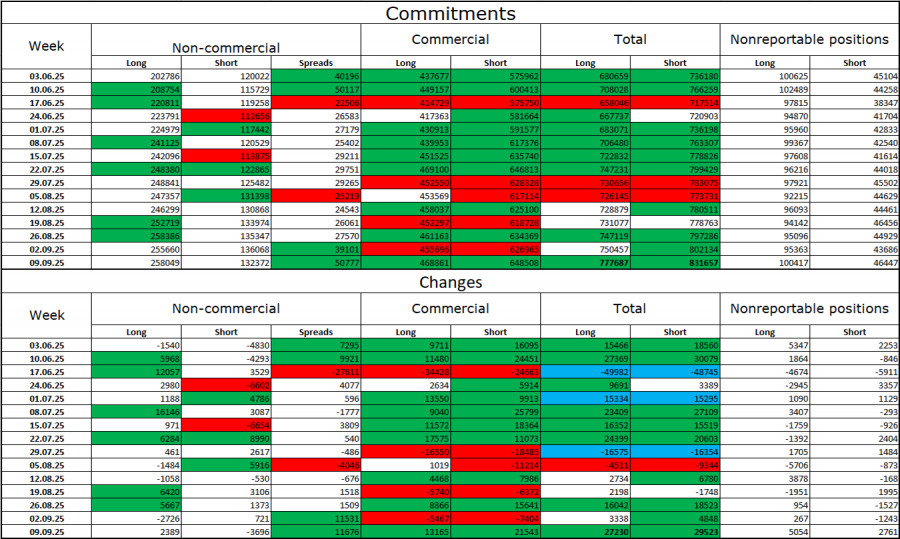

Commitments of Traders (COT) report:

During the last reporting week, professional traders opened 2,389 long positions and closed 3,696 short positions. The sentiment of the "Non-commercial" group remains bullish thanks to Donald Trump and is strengthening over time. The total number of long positions held by speculators now amounts to 258,000, while short positions total 132,000. The gap is essentially twofold. Also note the number of green cells in the table above, showing strong increases in euro positions. In most cases, interest in the euro continues to grow, while interest in the dollar falls.

For thirty-one consecutive weeks, large traders have been cutting short positions and adding longs. Donald Trump's policies remain the most significant factor for traders, as they may cause many problems of a long-term, structural nature for America. Despite the signing of several important trade agreements, many key economic indicators are declining.

News calendar for the U.S. and the Eurozone:

On September 18, the economic calendar contains two entries, neither of which I consider important. The influence of the news background on market sentiment on Thursday will be weak or nonexistent.

EUR/USD forecast and trader recommendations:

Sales could have been considered on the hourly chart at the rebound from 1.1896 with a target at 1.1802. The target has been met. Buying is possible today on a rebound from the 1.1789–1.1802 zone with a target at 1.1896. Selling on Thursday can be considered if the pair closes below the 1.1789–1.1802 zone, targeting 1.1695.

The Fibonacci grids are built between 1.1789–1.1392 on the hourly chart and between 1.1214–1.0179 on the 4-hour chart.

RÁPIDOS ENLACES