Trade Review and Tips for Trading the Euro

The test of the 1.1630 price level coincided with a moment when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the euro.

A large batch of economic data is expected to be released in the second half of the day. We start with data related to the construction sector: building permits and housing starts. The real estate market, a traditional driver of economic growth, is highly sensitive to even slight changes in interest rates and consumer confidence. An increase in permits and housing starts indicates confidence among builders and buyers, signaling a positive outlook. Conversely, a decline signals economic slowdown and a potential recession.

The University of Michigan Consumer Sentiment Index is another important economic indicator. It reflects consumers' willingness to spend on goods and services. High confidence supports economic growth, while low confidence leads to reduced demand and production. Inflation expectations also influence business and investor decisions. If price increases are expected, people are more likely to spend now to avoid future losses.

A rise in the dollar can only be expected if the incoming data exceeds economists' forecasts.

As for the intraday strategy, I will mostly rely on the implementation of scenarios #1 and #2.

Buy Signal

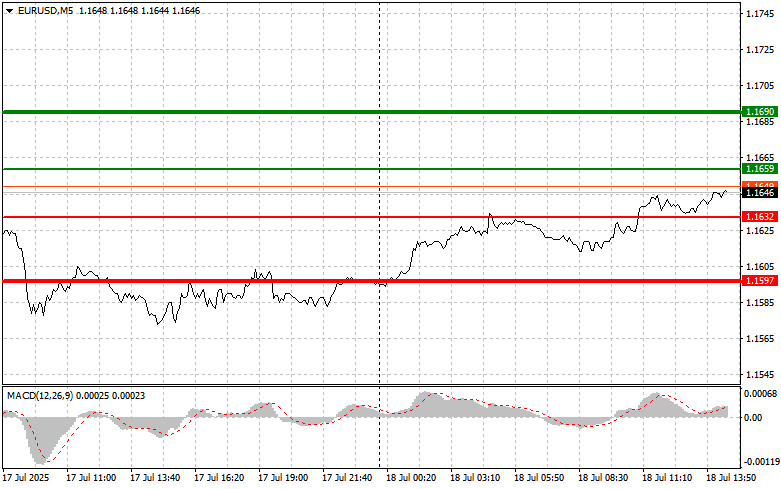

Scenario #1:Buying the euro today is possible around the 1.1659 level (green line on the chart) with a target of 1.1690. At 1.1690, I plan to exit the market and open a short position, aiming for a 30–35 point retracement from the entry level. A strong rise in the euro today is likely only if U.S. data disappoints. Important: Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2:I also plan to buy the euro today if there are two consecutive tests of the 1.1632 level, at a time when the MACD is in oversold territory. This would limit the pair's downward potential and trigger a reversal to the upside. Growth toward the opposing levels of 1.1659 and 1.1690 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.1632 level (red line on the chart). The target is 1.1597, where I intend to exit and open a long position in the opposite direction (expecting a 20–25 point retracement). Downward pressure may return if U.S. data comes in strong. Important: Before selling, make sure the MACD is below the zero line and just starting to move down from it.

Scenario #2:I also plan to sell the euro today in the event of two consecutive tests of the 1.1659 level, when the MACD is in overbought territory. This would limit the pair's upward potential and trigger a reversal downward. A decline toward the opposing levels of 1.1632 and 1.1597 can be expected.

Chart Legend:

Important:Beginner Forex traders must be very cautious when making market entry decisions. It's best to stay out of the market before major fundamental reports to avoid sharp price swings. If you decide to trade during news releases, always use stop-loss orders to minimize losses. Trading without stops can quickly wipe out your entire deposit, especially if you don't use money management and trade with large volumes.

And remember: for successful trading, a clear trading plan is essential—like the one outlined above. Spontaneous decision-making based on current market conditions is a losing strategy for intraday traders.

RÁPIDOS ENLACES