The EUR/USD currency pair continued its upward movement on Thursday, which aligns perfectly with the overall fundamental backdrop but does not correspond to the news of the day. Let's clarify once again. The overall fundamental background (global) has been and continues to work against the US dollar. Therefore, any increase in the pair is logical, while any decrease is purely technical, corrective, and illogical. Yesterday, the US shutdown officially ended —what did we see? A decline in the American currency. Where is the logic? There is none.

Many experts continue to devise various explanations for market movements, failing to understand a simple truth: illogical movements in the market happen. For example, if the pair is supposed to correct, we may see movements in the opposite direction despite the fundamentals and macroeconomics. Another example: in a flat market, prices move completely randomly, ignoring news and events. Therefore, when such a period begins, it is unnecessary to try to explain every price movement. One must simply accept these movements and understand what they are based on.

We observe these movements based on "pure technicality." On the daily timeframe, the euro is still trading within a sideways channel, so movements within this range (1.1400-1.1830) can be entirely arbitrary, regardless of fundamentals and macroeconomic factors. This is precisely why the dollar is falling now, ignoring the end of the shutdown. This is also why the dollar rose for a month and a half, disregarding both the dovish policy of the Fed and the shutdown, while many experts tried to explain the dollar's growth as due to warming relations between China and the US and the "not dovish enough" stance of the Fed.

Therefore, in the long term, we continue to expect only declines in the American currency. Within the flat channel on the daily timeframe, movements can be entirely arbitrary, but it is evident that as long as this channel remains, buying the pair near its lower boundary can be very profitable.

In general, it makes little sense to consider other events from yesterday. First, there were none. Second, the market ignores them anyway. The price is above the moving average line, which is already sufficient to continue rising. Unfortunately, due to the same flat, market volatility remains quite weak. However, the prospects for further movement are quite clear and obvious. The dollar still has no global factors supporting it.

It is only worth mentioning all the unpublished statistics from the past month and a half. These reports will be published, but they will be delayed even relative to the end of the shutdown. The Bureau of Labor Statistics needs to process data collection, analysis, and report generation. Therefore, we should not expect labor market and unemployment information from the US until late next week. The pair could soon aim for the level of 1.1840 and above, as this level is the upper line of the sideways channel.

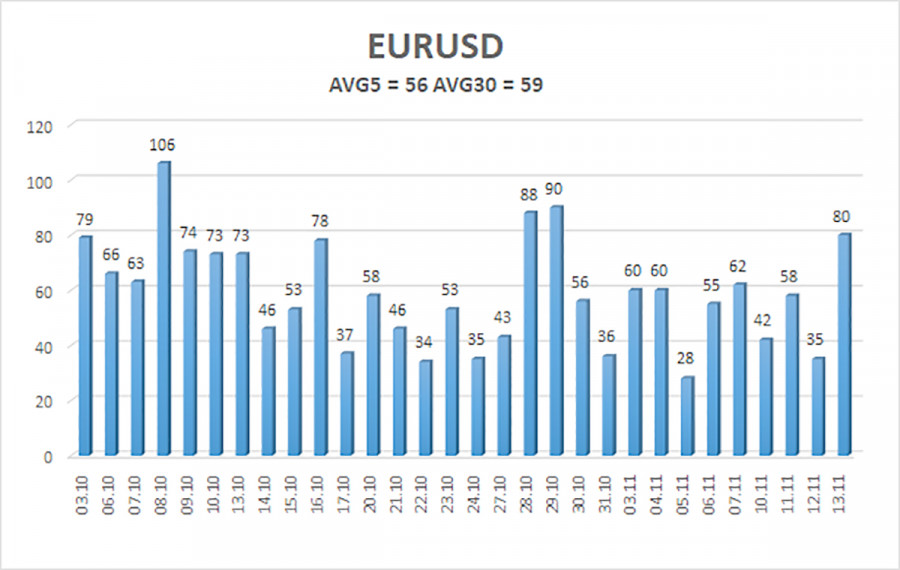

The average volatility of the EUR/USD currency pair over the last five trading days as of November 14 is 56 pips, which is "average." We expect the pair to move between levels 1.1594 and 1.1706 on Friday. The upper channel of linear regression is directed downward, signaling a bearish trend, but in fact, a flat continues on the daily timeframe. The CCI indicator entered the oversold area twice in October (!!!), which may provoke a new phase of the upward trend for 2025.

S1 – 1.1597

S2 – 1.1536

S3 – 1.1475

R1 – 1.1658

R2 – 1.1719

R3 – 1.1780

The EUR/USD pair has once again settled above the moving average; the upward trend remains intact across all higher timeframes, and the daily timeframe has been flat for several months. The global fundamental background continues to have a strong impact on the US dollar. Recently, the dollar has risen, but the reasons for this movement may be purely technical. If the price is below the moving average, small short positions with a target of 1.1475 can be considered on purely technical grounds. Above the moving average line, long positions remain relevant, targeting 1.1800 (the upper line of the flat on the daily timeframe).

SZYBKIE LINKI