Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

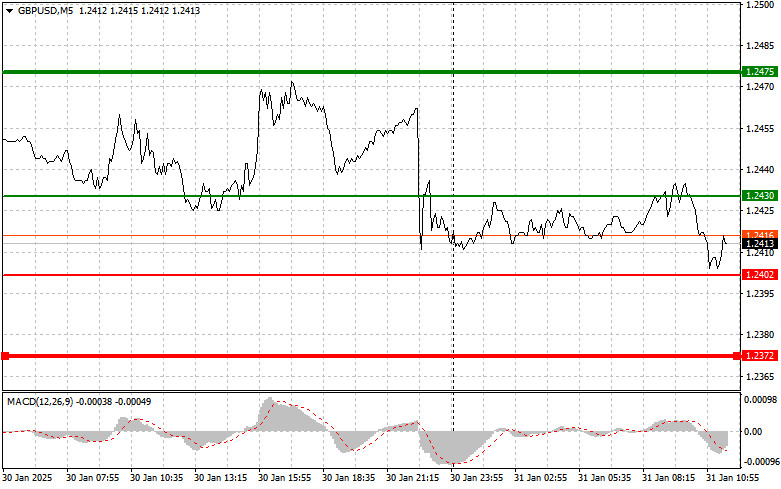

The first test of 1.2429 occurred when the MACD indicator had already moved significantly above zero, limiting the pair's upside potential. For this reason, I did not buy GBP/USD.

A second test of 1.2429 happened later when MACD was in the overbought zone, triggering Scenario #2 for selling. This led to a 30-point decline in GBP/USD, confirming the effectiveness of the setup.

The market remains under pressure, and for bulls to regain control, they need a strong breakout above 1.2430. Sellers are clearly dominant, as seen in the increasing trading volume around current price levels.

Additionally, U.S. economic data should not be underestimated. Reports on inflation and consumer spending could significantly influence the Federal Reserve's decision-making process, ultimately affecting the U.S. dollar's strength.

If U.S. economic data beats expectations, GBP/USD could face additional pressure. Weak U.S. Core PCE Price Index data, combined with dovish rhetoric from FOMC member Michelle Bowman, could weaken the dollar and support GBP/USD.

A soft stance on interest rates could lead to increased investor demand for the pound, making GBP/USD a more attractive asset in the short term.

Important! Before buying, confirm that MACD is above zero and beginning to rise.

Important! Before selling, confirm that MACD is below zero and beginning to decline.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

SZYBKIE LINKI