Společnost Viking Holdings Ltd (NYSE:VIK) zveřejnila výsledky za první čtvrtletí, které překonaly očekávání trhu. Ztráta činila 0,24 USD na akcii, zatímco odhady počítaly se ztrátou 0,28 USD.

Tržby dosáhly 897,1 milionu dolarů. Přestože společnost stále vykazuje ztrátu, oproti předchozímu roku došlo ke zlepšení. Akcie vzrostly v předobchodní fázi o 1,42 %.

Analytici očekávají další komentáře k výhledu během nadcházející konferenční hovoru.

Analysis of Trades and Trading Recommendations for the Euro

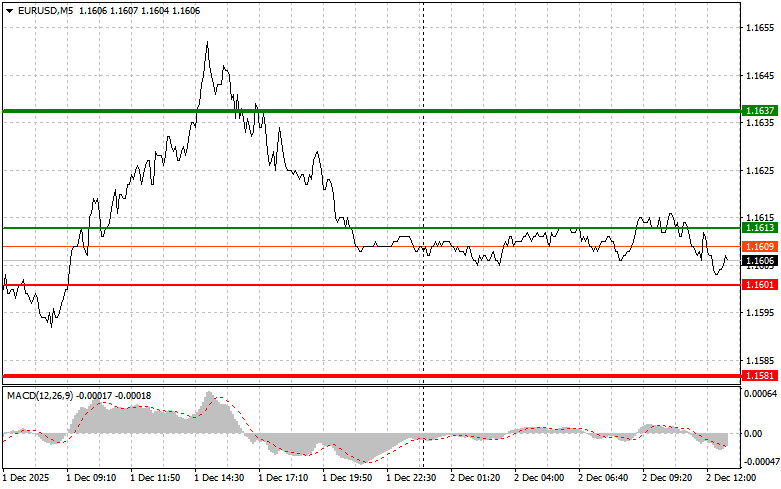

The test of the 1.1616 price occurred at a moment when the MACD indicator had already moved significantly upward from the zero mark, which limited the pair's bullish potential. For this reason, I did not buy euros.

The inflation data published for the eurozone for November matched analysts' forecasts. The consumer price index in the region rose by 2.1%, which remains within the central bank's target range. This moderate growth in prices does not influence the ECB and forces it to maintain low interest rates.

In the second half of the day, everyone is waiting for the speech by FOMC member Michelle Bowman, although it is unlikely that she will address monetary policy issues. The RCM/TIPP U.S. Economic Optimism Index will also be released. This index will provide some insight into the sentiment of American consumers and investors. Readings above forecasts may temporarily strengthen the dollar, indicating increased confidence in economic growth. It is important to remember that this index usually has limited influence, especially against the background of major macroeconomic events that shape the global economic landscape.

As for the intraday strategy, I will mostly rely on the implementation of scenarios No. 1 and No. 2.

Buy Signal

Scenario No. 1: Today, buying euros is possible when the price reaches the level around 1.1613 (green line on the chart), with a target at 1.1637. At 1.1637, I plan to exit the market and also sell euros in the opposite direction, expecting a 30–35-point movement from the entry. A strong rise in the euro can be expected after weak U.S. data. Important! Before buying, make sure the MACD indicator is above the zero mark and is just beginning to rise from it.

Scenario No. 2: I also plan to buy euros today if the price tests 1.1601 twice while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a reversal upward. Growth toward the opposite levels of 1.1613 and 1.1637 can be expected.

Sell Signal

Scenario No. 1: I plan to sell euros after the price reaches 1.1601 (red line on the chart). The target will be 1.1581, where I plan to exit the market and immediately buy in the opposite direction (expecting a 20–25-point rebound). Pressure on the pair will return today if the statistics are strong.Important! Before selling, make sure the MACD indicator is below the zero mark and is just beginning to decline from it.

Scenario No. 2: I also plan to sell euros today if the price tests 1.1613 twice while the MACD indicator is in the overbought zone. This will limit the upward potential and lead to a downward reversal. A decline toward the opposite levels of 1.1601 and 1.1581 can be expected.

Explanation of Chart Elements:

Important:Beginner Forex traders must be very cautious when making entry decisions. Before major fundamental reports are released, it is best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use proper money management and trade with large positions.

And remember: successful trading requires a clear trading plan, like the one provided above. Making spontaneous decisions based only on the current market situation is, from the start, a losing strategy for any intraday trader.

فوری رابطے