The euro, pound, and other risk assets continue to show strength against the US dollar.

Yesterday, amid a lack of key data, the euro continued to strengthen against the US dollar, reaching a weekly high. The pound also strengthened as many traders bet on the imminent conclusion of the shutdown in the US. However, despite the optimistic sentiment, some caution remains. Even after the shutdown ends, its consequences will be felt by the American economy for some time. Specifically, this concerns delays in the publication of important macroeconomic data, which will not be prepared in a single day and will take quite some time.

Today, in the first half of the day, figures for the Consumer Price Index and changes in industrial production in Italy will be released. These data will serve as an important indicator of the country's economic state and may influence the euro's exchange rate. High inflation figures may prompt the European Central Bank to maintain a wait-and-see position on interest rates, which would support the euro. At the same time, growth in industrial production will indicate a strengthening economy and increased demand for goods and services. The impact of this data will be particularly noticeable in the context of the current situation in the US. Expectations of an imminent end to the shutdown in the US, as noted earlier, are putting pressure on the dollar. However, if the Italian data turn out to be weak, this could offset this factor and lead to a weakening of the euro.

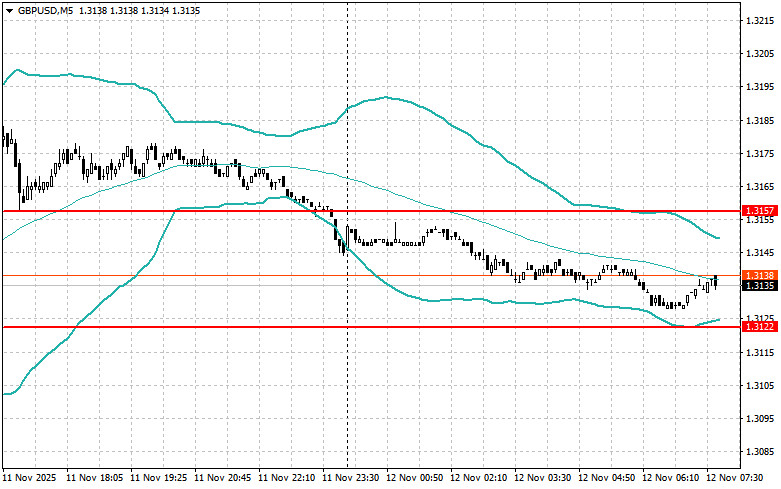

Regarding the pound, aside from today's speech by Bank of England Monetary Policy Committee member Huw Pill, no other data are scheduled, so the market's focus will shift entirely to his statements. Traders are closely monitoring his every word, looking for hints about the BoE's future monetary policy. His comments on fighting inflation, prospects for economic growth, and future actions regarding interest rates will be particularly important.

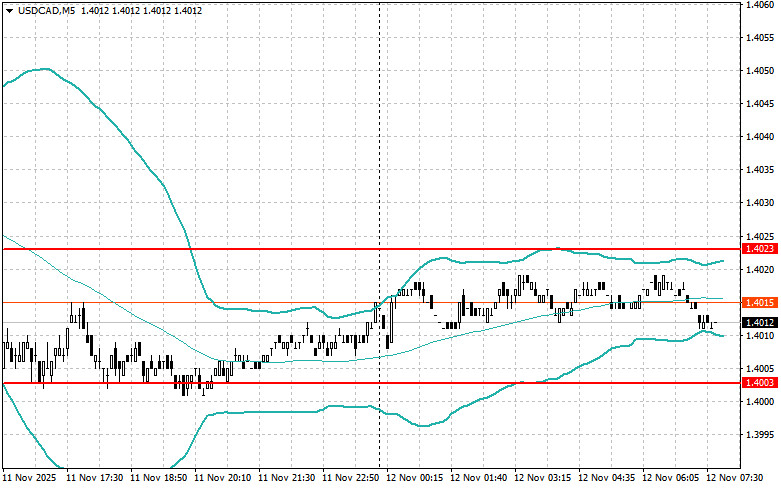

If the data aligns with economists' expectations, it is better to act on the Mean Reversion strategy. If the data is significantly above or below economists' expectations, the Momentum strategy will be most effective.

فوری رابطے