Italská energetická společnost Eni zahájila exkluzivní jednání se společností Ares Alternative Credit Management o prodeji 20% podílu ve své divizi obnovitelných zdrojů a maloobchodu Plenitude, jak ve čtvrtek oznámila energetická skupina.

Jednání se soustředí na hodnotu vlastního kapitálu Plenitude, která se pohybuje mezi 9,8 a 10,2 miliardami eur.

Toto ocenění odpovídá hodnotě podniku přesahující 12 miliard eur, tedy zhruba 13,4 miliardy dolarů.

The correction is postponed. The market is once again buying the dips. History demonstrates that since 1981, a month after the end of government shutdowns, the S&P 500 has averaged a 2.3% increase. This suggests that by mid-December, the broad stock index could reach the 7,000 mark. Moreover, the end of the year is typically a favorable period for the US stock market. From Veterans Day onward, the market usually rises by an average of 2.3% to 2.5%.

The US government shutdown will soon be a thing of the past. This shutdown turned out to be the longest on record, yet during it, the S&P 500 gained 2.2%. Despite the Congressional Budget Office's warnings that the government's inactivity could subtract 1.5 percentage points from US GDP, investors found reasons for optimism.

The strongest driver has been the most robust earnings season since early 2021. Actual earnings data exceeded analysts' forecasts by a factor of two. At the same time, investor attention is gradually shifting to NVIDIA's third-quarter report, which will be released on November 19 and is sure to lead to significant market fluctuations.

Dynamics of S&P 500 sectors

Rumors of the end of the shutdown have produced mixed impressions in the stock market. At the start of the week, battered tech stocks rallied before November 14. However, the following day, they fell while healthcare and energy stocks surged. Investors are diversifying their portfolios. They still doubt whether the colossal investments in artificial intelligence will pay off.

Meanwhile, bad news from the economy is becoming good for the S&P 500. According to ADP, private sector employment decreased, and the market is making titanic efforts to create new jobs. Goldman Sachs expects a reduction of 50,000 in October's non-farm payrolls, while 71% of Americans surveyed by the University of Michigan predict rising unemployment.

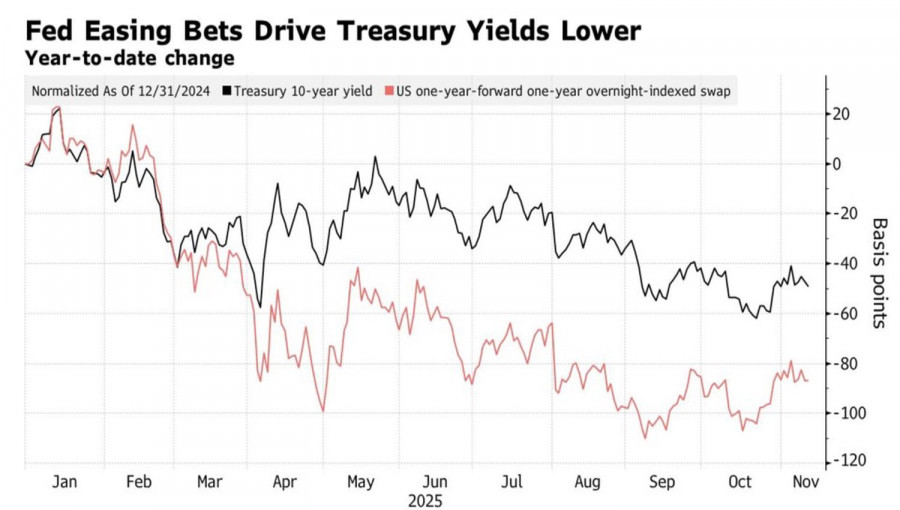

Dynamics of Treasury yield and scale of Fed monetary expansion

US stock markets are not deterred by disappointing statistics. Investors interpret weakness in the data as a reason for a Federal Reserve rate cut. As a result, derivatives are raising the chances of a cut in December to 65%, and Treasury yields are falling. This creates a favorable atmosphere for the S&P 500. Lower borrowing costs will reduce expenses for companies and increase their profits.

Markets are eagerly awaiting the end of the shutdown and the release of important official statistics. Based on previous government shutdown experiences, the September job openings report may be published as soon as November 19, with inflation data expected on November 26.

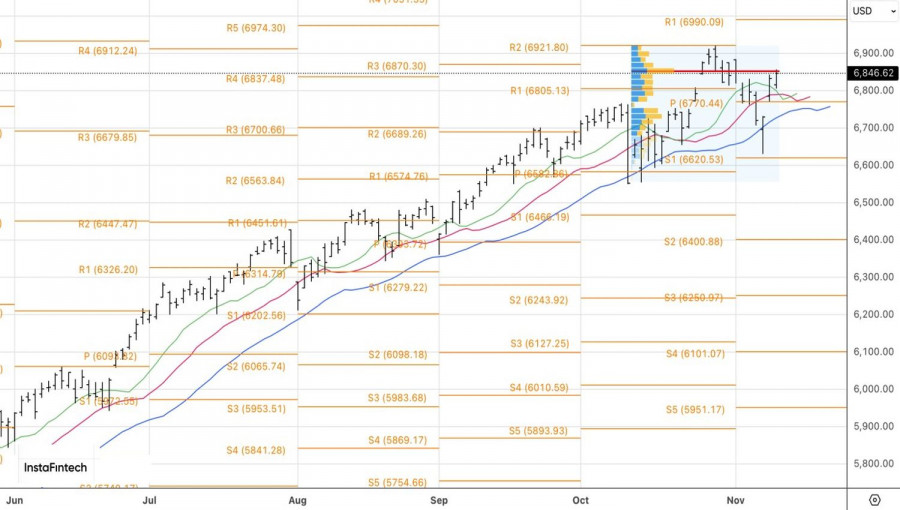

Technically, on the daily chart of the S&P 500, bulls aim to restore the upward trend. A necessary condition for this is to storm the fair value at 6,855. A break above this level will allow traders to increase previously established long positions in the broad stock index.

QUICK LINKS