Sezóna zveřejňování výsledků pokračuje a my jsme tu, abychom vám představili společnosti, které by měly oznámit své výsledky v příštím obchodním dni, a pomohli vám tak připravit se na vývoj na trzích. V čele seznamu pro pondělí 26. května 2025 je YY Inc (NASDAQ:JOYY), významný hráč v odvětví sociálních médií a zábavy.

The GBP/USD currency pair also traded higher on Monday, which few expected. However, in the article on EUR/USD, we already outlined our view on why both the euro and the pound might resume their global uptrends during the New Year holidays. To recap, any decline in either currency pair is an inherent correction. This correction has already lasted 6 months and has been prolonged. Therefore, even if the euro and pound rise simply without any news support, it would still be logical and expected.

On Monday, the only report published in the UK for the week generated little market interest. In principle, we had warned that expecting strong movement from the GDP report following a crazy week packed with neglected events was overconfident. Thus, it is clear that the GDP report was not the reason behind the rise of the pound and the euro. In any case, the third estimate aligned completely with forecasts, so there was nothing to react to. The British economy continues to grow weakly as before.

However, on the daily timeframe, the price spent about seven days just above the Senkou Span B line, but yesterday it made another attempt to rebound and resume the global uptrend. Recall that breaking above the Senkou Span B line, especially on the daily timeframe, is a very strong signal of a trend change. Therefore, we were previously expecting growth only from the British pound, and now we are even more so. From our perspective, it does not even matter that next year the Federal Reserve will be cutting the key rate alongside the Bank of England. The dollar has simply exhausted its reserves of luck. The end of September and all of October saw the dollar rise without any real grounds. Recall that in mid-September, the Fed resumed its monetary policy easing cycle, and on October 1, a "shutdown" began in America, with Donald Trump announcing new tariffs.

Thus, the dollar rose without cause, while the pound fell without sufficient reason. Therefore, the GBP/USD pair may rise even without support from local macroeconomic and fundamental backgrounds. As before, we expect the pair to hover around the peaks of the current year, namely around the 1.3800 level. And this upward movement will not end, as the global uptrend persists and Donald Trump's policy remains unchanged: "do everything to make the dollar cheaper."

This week, there will be only one interesting event today; the market can react to it, after which full-scale Christmas celebrations will begin. This does not mean that the market will be closed. It means that trading volumes will drop to a minimum. But in a "thin market," this may actually play into the hands of the current trend, which has long needed to resume.

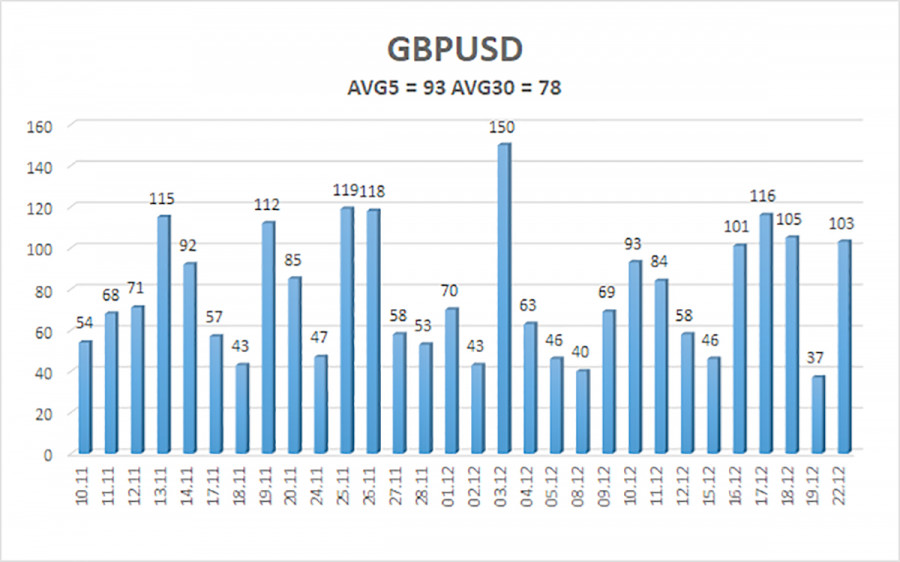

The average volatility of the GBP/USD pair over the past five trading days is 93 pips. For the pound/dollar pair, this value is considered "average." On Tuesday, December 23, we expect movement within the range limited by levels 1.3363 and 1.3549. The upper channel of linear regression is directed downward, but only due to a technical correction on higher timeframes. The CCI indicator has entered the oversold area six times over the past months and has formed numerous "bullish" divergences, continually warning of a resumption of the upward trend. Last week, the indicator formed another bullish divergence, signaling a resumption of growth.

S1 – 1.3428

S2 – 1.3367

S3 – 1.3306

R1 – 1.3489

R2 – 1.3550

The GBP/USD currency pair is attempting to resume its upward trend from 2025, and its long-term prospects remain unchanged. Donald Trump's policies will continue to pressure the dollar, so we do not expect the US currency to grow. Thus, long positions with targets at 1.3489 and 1.3550 remain relevant for the near future when the price is above the moving average. If the price is below the moving average line, we can consider small shorts with targets at 1.3306 and 1.3245 on technical grounds. From time to time, the US currency shows corrections (on a global scale), but for the trend to strengthen, it needs signs of an end to the trade war or other positive global factors.

The linear regression channels help determine the current trend. If both are directed in the same way, then the trend is strong;

The moving average line (settings 20,0, smoothed) determines the short-term trend and the direction in which to trade;

Murray levels – target levels for movements and corrections;

Volatility levels (red lines) – the probable price channel in which the pair will spend the next day based on current volatility readings;

The CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is imminent.

ລິ້ງດ່ວນ