Trade Review and Japanese Yen Trading Recommendations

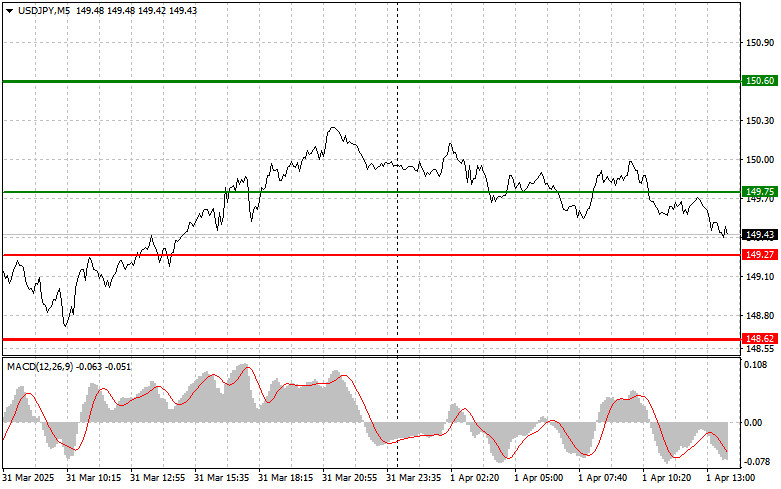

The test of the 149.93 level occurred at a time when the MACD indicator had already moved significantly above the zero line, limiting the pair's upward potential. For this reason, I didn't buy the dollar. I also didn't get a second test of the 149.93 level to enter a sell position and ended up missing the downward move.

Today's upcoming public statement by FOMC member Thomas Barkin is under close market scrutiny. Given Barkin's known preference for a more conservative monetary policy stance, his speech—especially on the eve of key developments tomorrow—may have a significant impact on the dollar's performance. In the current climate of uncertainty around the Fed's next moves due to upcoming U.S. tariff announcements (details expected tomorrow), few are willing to take risks. Any hawkish remarks will likely be interpreted as a signal to strengthen the U.S. currency.

As for intraday strategy, I'll primarily rely on the implementation of Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy USD/JPY today after the pair reaches the entry point at around 149.75 (green line on the chart), targeting a rise to 150.60 (thicker green line). Near 150.60, I will exit long positions and open short ones in the opposite direction (expecting a 30–35 point pullback). The pair's upward move may be considered a corrective rebound. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise.

Scenario #2: I also plan to buy USD/JPY if there are two consecutive tests of the 149.27 level while the MACD is in oversold territory. This will limit the pair's downward potential and prompt a market reversal to the upside. A rise toward 149.75 and 150.60 is possible.

Sell Signal

Scenario #1: I plan to sell USD/JPY today after the price breaks below the 149.27 level (red line on the chart), which may trigger a rapid decline. The key target for sellers will be 148.62, where I plan to exit short positions and open long ones immediately in the opposite direction (expecting a 20–25 point bounce). Pressure on the pair can emerge at any moment. Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of the 149.75 level while the MACD is in overbought territory. This will cap the upward potential and trigger a reversal to the downside. A drop toward the 149.27 and 148.62 levels can be expected.

Chart Legend:

Important Notice for Beginners

Beginner Forex traders should be extremely cautious when entering the market. It's best to stay out of the market before the release of major fundamental reports to avoid sharp price swings. If you decide to trade during news events, always use stop-loss orders to minimize potential losses. Without them, you could quickly lose your entire deposit—especially if you don't apply proper money management or trade with large positions.

And remember: successful trading requires a clear trading plan, like the one I've outlined above. Making spontaneous decisions based on the current market situation is an inherently losing strategy for intraday traders.

ລິ້ງດ່ວນ