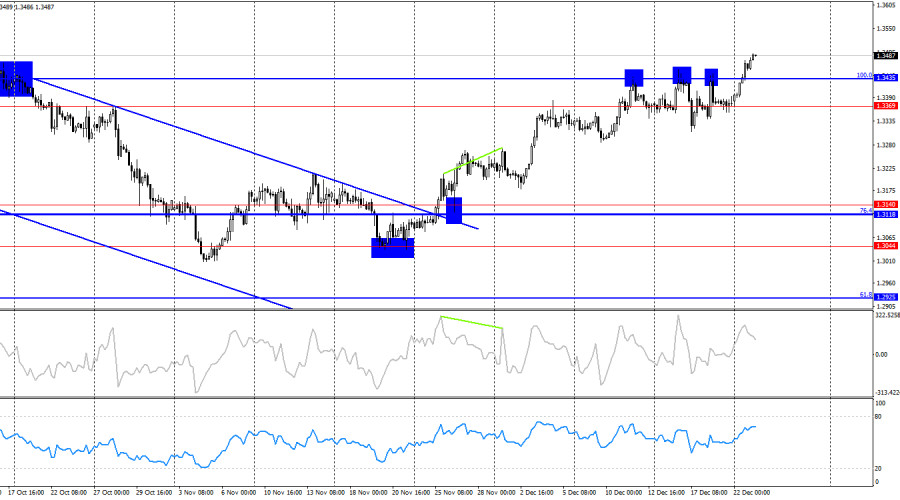

On the hourly chart, the GBP/USD pair on Monday continued its upward movement after rebounding from the 1.3352–1.3362 support level. During the day, prices consolidated above the 1.3437 and 1.3470 levels. Thus, the growth process may continue toward the next level at 1.3539. A consolidation of quotes below the 1.3437 level would once again work in favor of the U.S. dollar and return the pair to the sideways range of 1.3352–1.3437.

The wave situation has once again turned "bullish" after the completion of the sideways phase. The last completed downward wave did not break the previous low, while the new upward wave managed to break the previous peak. The news background for the British pound has been weak in recent weeks, but the information backdrop in the United States also leaves much to be desired. Bulls and bears had been in a tug-of-war for a week and remained in relative balance, but a week before the New Year the bulls launched a new offensive.

The news background on Monday was weak. UK GDP came in neutral relative to traders' expectations, but the bulls found reasons for a new attack. I would like to remind you that if we look at the global economic situation and take into account the status of the dollar as the "world's reserve currency," its decline should continue. Key labor market and unemployment reports last week showed no improvement. Along with these data, it became known that U.S. inflation is slowing, which to some extent gives the Fed more room to ease monetary policy. Thus, the market expects interest rate cuts to continue in 2026. And despite similar expectations regarding the Bank of England, the dollar remains under pressure, as it is a more significant currency for the global economy than the British pound. It should also be remembered that regardless of the news background, the "bullish" trend remains intact. This is clearly visible on the hourly, 4-hour, and daily charts.

On the 4-hour chart, the pair consolidated above the 100.0% corrective level at 1.3435. Thus, the upward movement may continue toward the next Fibonacci level at 127.2% – 1.3795. No emerging divergences are observed on any indicator today.

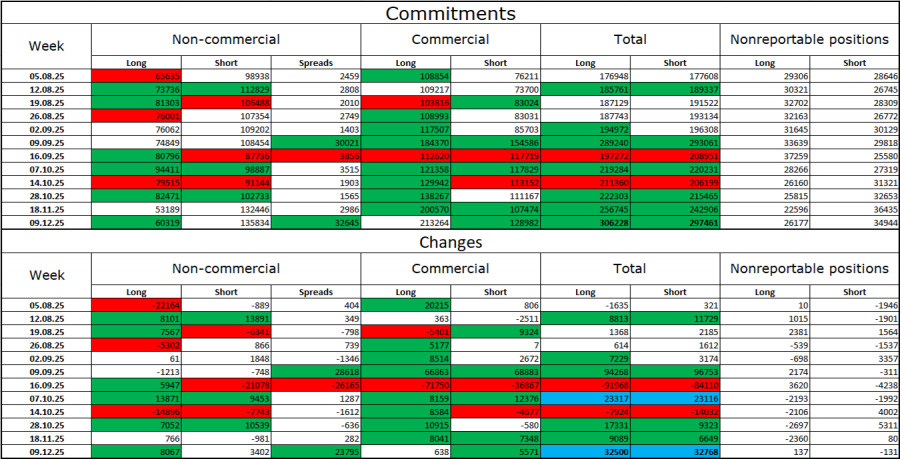

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" trader category became more bullish over the latest reporting week. The number of long positions held by speculators increased by 8,067, while the number of short positions rose by 3,402. The gap between the number of long and short positions is now effectively as follows: 60,000 versus 135,000. As we can see, bears have dominated since early December, but the pound appears to have already exhausted its downward potential. At the same time, the situation with euro contracts is exactly the opposite. I still do not believe in a "bearish" trend for the pound.

In my view, the pound still looks less "dangerous" than the dollar. In the short term, the U.S. currency occasionally enjoys demand in the market, but I believe this is a temporary phenomenon. Donald Trump's policies have led to a sharp deterioration in the labor market, and the Fed is forced to ease monetary policy in order to halt the rise in unemployment and stimulate the creation of new jobs. For 2026, the FOMC does not plan aggressive monetary easing, but at present no one can be sure that the Fed's stance will not shift to a more "dovish" one during the year.

News calendar for the U.S. and the UK:

On December 23, the economic calendar contains three entries that are of some interest. The impact of the news background on market sentiment on Tuesday may be present, but in the second half of the day.

GBP/USD forecast and trading advice:

Short positions can be opened if prices close below the 1.3437 level on the hourly chart, with targets at 1.3352–1.3362. I previously recommended opening long positions on a rebound from the 1.3352–1.3362 level with targets at 1.3425 and 1.3470. These targets have been reached. Today, these trades can be kept open with a target at 1.3539.

The Fibonacci grids are plotted from 1.3470 to 1.3010 on the hourly chart and from 1.3431 to 1.2104 on the 4-hour chart.