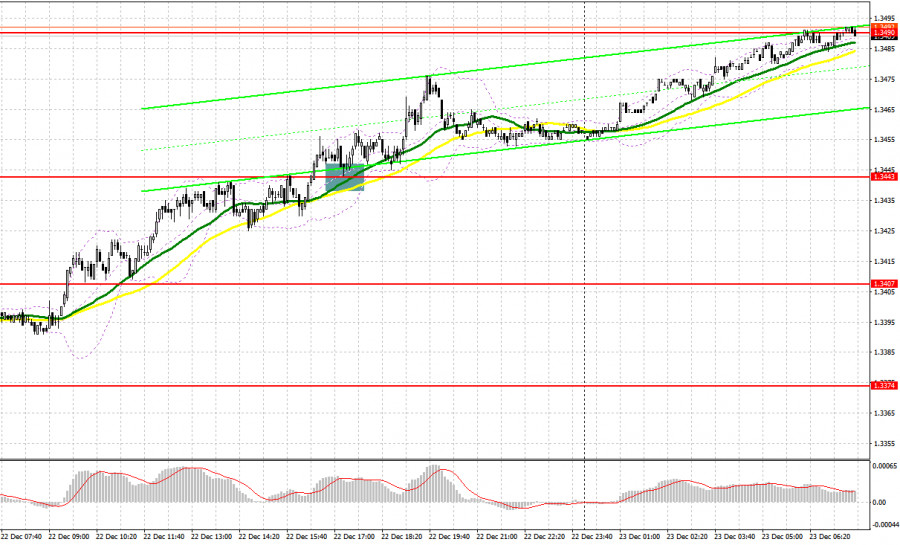

Yesterday, only one entry point into the market was formed. Let's take a look at the 5-minute chart and analyze what happened. In my morning forecast, I highlighted the level of 1.3402 and planned to make decisions based on it. The rise and breakout at 1.3402 occurred without a retest, so I was unable to get an entry point for long positions. In the afternoon, a false breakout at 1.3443 provided an excellent entry point to buy the pound, resulting in the pair rising by more than 30 pips.

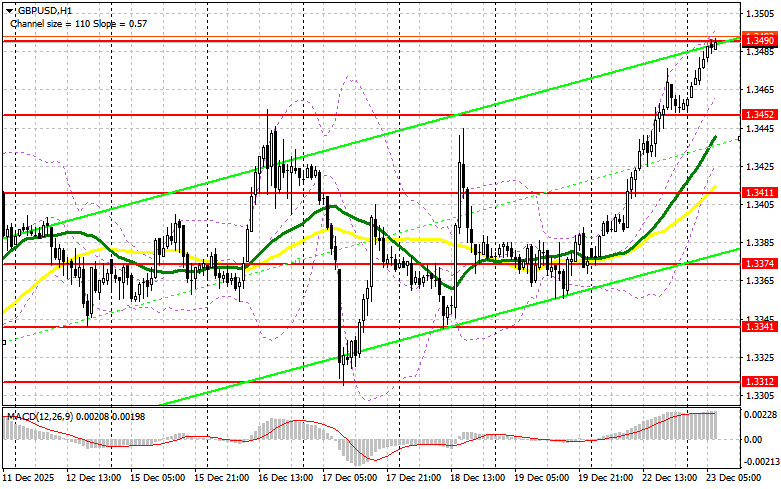

The pound reacted positively to the UK GDP data. The bullish market received support in the afternoon amid rising expectations for further US rate cuts. Today, there is no report from the UK, so sellers of the pound will have much less reason to be active. This is better for buyers. I expect to see their first signs already during a correction around the support level of 1.3452. A false breakout would be a good opportunity to open long positions with the aim of further growth towards the resistance level of 1.3490, where trading is currently taking place. A breakout and retest of this range from above will increase the chances of GBP/USD strengthening, triggering stop orders for sellers and providing an appropriate entry point for long positions, with the potential to reach 1.3525. The furthest target will be around 1.3567, where I plan to take profits. If GBP/USD declines and there is no buying at 1.3452, pressure on the pair will increase, leading to a move towards the next support level at 1.3411. Only a false breakout there would be a suitable condition for opening long positions. I plan to buy GBP/USD on a bounce from the 1.3374 low, targeting an intraday correction of 30-35 pips.

Pound sellers have adopted a wait-and-see stance and are clearly in no hurry to reenter the market. If the pair continues to rise, bears can expect to act around the nearest resistance at 1.3490. A false breakout there will provide grounds for selling GBP/USD, targeting the support level of 1.3452, where slightly lower moving averages are located, favoring the bulls. A breakout and retest from below this range after weak data would deal a more significant blow to buyer positions, leading to stop orders being triggered and opening a path to 1.3411. The furthest target will be the 1.3374 area, where I will take profits. If GBP/USD continues to rise and bears remain inactive at 1.3490, buyers will continue to develop the trend, which could lead to a surge towards 1.3525. I also plan to open only short positions there on a false breakout. If there is no downward movement even there, I will sell GBP/USD immediately on a bounce from 1.3567, but only in anticipation of a downward correction of the pair by 30-35 pips during the day.

Due to the shutdown in the US, fresh data on the Commitment of Traders (COT) is not being published. As soon as an updated report is prepared, we will publish it immediately. The latest relevant data is only as of December 9.

In the COT report (Commitment of Traders), there was an increase in both long and short positions. The last COT report indicates that long non-commercial positions rose by 8,067 to 60,319, while short non-commercial positions jumped by 3,402 to 135,834. As a result, the spread between long and short positions increased by 23,795.