Akcie společnosti Imunon Inc (NASDAQ:IMNN) vyskočily v předobchodní fázi o 172 % poté, co společnost oznámila zásadní data o přežití z fáze 2 klinické studie IMNN-001, experimentální léčby pro ženy s nově diagnostikovanou pokročilou rakovinou vaječníků. Výsledky byly představeny na výročním zasedání Americké společnosti klinické onkologie (ASCO) 2025 a zároveň publikovány v odborném časopise Gynecologic Oncology.

Studie s názvem OVATION 2 ukázala, že pacientky léčené přípravkem IMNN-001 v kombinaci se standardní neoadjuvantní a adjuvantní chemoterapií (N/ACT) zaznamenaly mediánové prodloužení celkového přežití (OS) o 13 měsíců oproti těm, které dostávaly pouze standardní léčbu. Poměr rizik činil 0,69. Také došlo ke zlepšení v oblasti přežití bez progrese (PFS), kde byl rozdíl 3 měsíce ve prospěch léčené skupiny, s hazard ratio 0,79.

Ještě výraznější efekt byl pozorován u pacientek, které po chemoterapii dostávaly jako udržovací terapii inhibitory PARP. U této podskupiny zatím medián celkového přežití nebyl dosažen ani po pěti letech, zatímco ve srovnávací skupině činil 37 měsíců – to naznačuje potenciální prodloužení života o více než jeden rok u žen s nově diagnostikovanou pokročilou formou onemocnění.

Na základě těchto povzbudivých dat byla zahájena fáze 3 studie OVATION 3, která se zaměří na celkové přežití jako primární cíl. Studie bude zahrnovat také podskupinu žen s deficiencí homologní rekombinace (HRD+), včetně pacientek s mutacemi BRCA1 nebo BRCA2.

Léčba IMNN-001 byla dobře snášena – nejčastějšími vedlejšími účinky byly bolest břicha, nevolnost a zvracení, bez výskytu závažných imunitních reakcí.

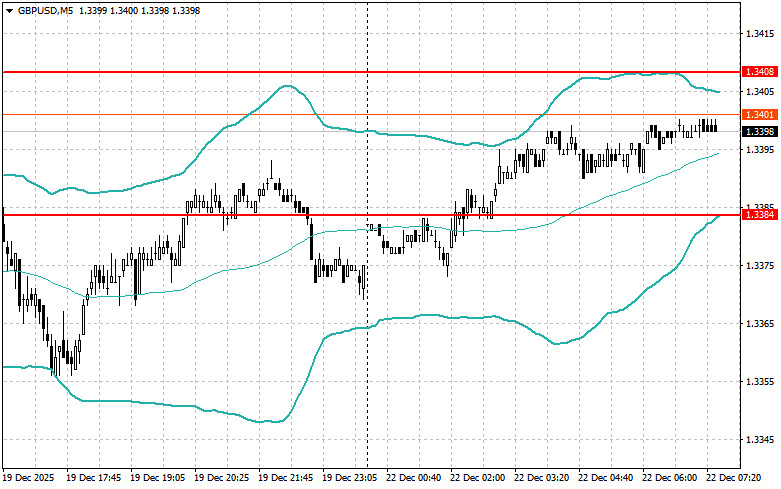

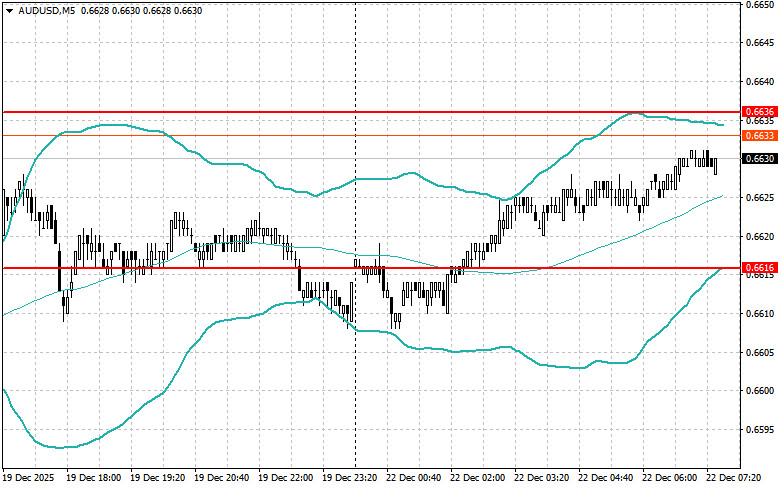

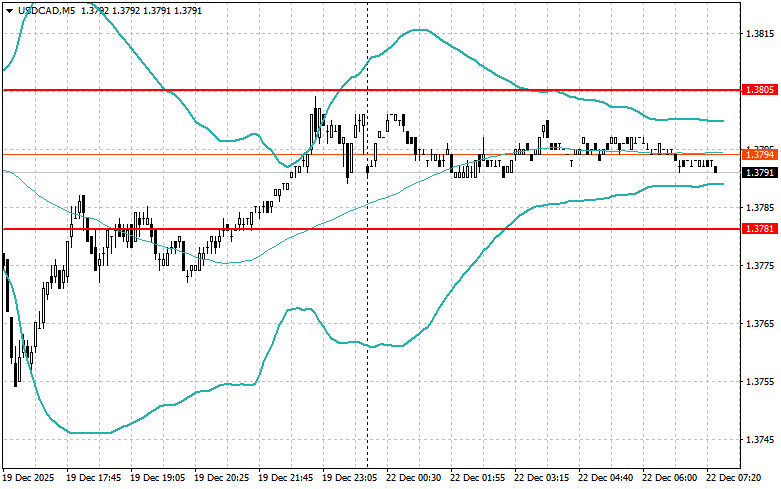

The euro and the British pound maintained their positions against the U.S. dollar, unlike the Japanese yen, which fell sharply.

However, the dollar still faced pressure after disappointing data from the University of Michigan's consumer sentiment index, but this did not lead to any drastic market changes. Participants likely decided to wait for more significant economic indicators. Clarity regarding the Federal Reserve's future monetary policy remains crucial to restraining active trading.

Today, there is no data from the Eurozone, so significant market movements are not expected in the first half of the day. However, this calm before the storm can be deceptive. Markets possess an astonishing ability to anticipate, and may already be pricing in upcoming events. Traders' attention might shift to other regions. Furthermore, we should not overlook the geopolitical situation. Any unexpected news or escalation of tensions in the various areas of the world could trigger a flight to safe-haven assets.

As for the pound, important reports on the UK's third-quarter GDP volume and the current account balance are expected in the first half of the day. These macroeconomic indicators will provide fresh insights into the state of the British economy. The change in GDP for the third quarter will serve as a key indicator to assess how successfully the UK is managing high inflation and high rates. It is clear that nothing good is expected from GDP. The report on the current account balance will reflect the difference between the country's exports and imports. A current account deficit may indicate that a country spends more than it earns, which could lead to a decline in the value of its national currency and other economic problems. Conversely, a surplus may indicate a strong export orientation and a stable economic position.

If the data aligns with economists' expectations, it is best to act based on the Mean Reversion strategy. If the data is significantly above or below expectations, the Momentum strategy is preferred.