The S&P 500 has successfully navigated the recent release of US inflation data, despite not capitalizing on the slowdown in consumer prices to 2.7% and the core index to 2.6%. Investors remain skeptical of the figures from the Bureau of Labor Statistics following the prolonged government shutdown. However, according to Wells Fargo, the disinflationary trend is ongoing, even if the latest statistics may exaggerate the extent of the CPI decline.

The US economy maintains a remarkable balance of resilience. It is not overheating enough to trigger rising inflation and provoke a tightening of the Federal Reserve's monetary policy. Consequently, a Goldilocks environment has been created for American stocks, allowing the S&P 500 to feel confident. Moreover, tensions surrounding geopolitical and trade risks are gradually easing. Investors are optimistic about an imminent peace in Eastern Europe and welcome the absence of escalations in tariff conflicts between the United States and China.

S&P 500 and Federal Funds Rate Dynamics

The S&P 500 is gaining strength from expectations surrounding the continuation of the Federal Reserve's monetary expansion cycle. Jerome Powell believes that the impact of tariffs on inflation will be relatively short-lived. Christopher Waller asserts that there will be no acceleration in prices in 2026, and John Williams, the president of the New York Fed, is encouraged by the muted effects of trade policy on inflation. The top officials of the FOMC are convinced that the labor market is the primary focus. It is no surprise that investors continue to anticipate a reduction in the federal funds rate.

When combined with positive forecasts for corporate profits and hopes surrounding artificial intelligence technology, this paints a bright future for the S&P 500. Optimists believe that there will be no bad news for the US stock market until year-end, as it has already weathered the test of American inflation. Thus, it is the perfect time to start thinking about the traditional Christmas rally.

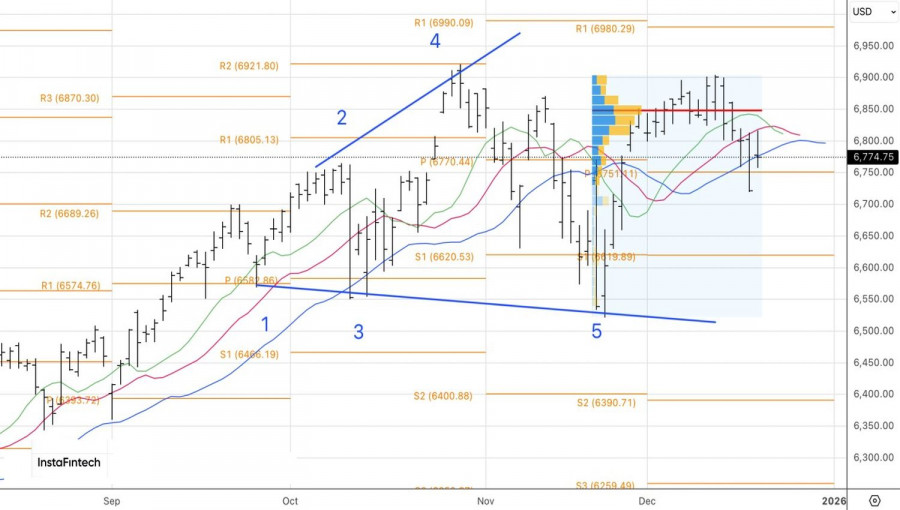

S&P 500 and Moving Averages Dynamics

Despite the S&P 500's flirtation with the 50-day moving average, more than three-quarters of Bloomberg surveyed asset managers are positioning themselves for a more risky environment in 2026. Deutsche Bank, Morgan Stanley, and RBC Capital Markets are forecasting a rally of over 10% for the S&P 500 next year.

Certainly, risks have not evaporated. The economy could start to falter, and inflation may unexpectedly accelerate. A stagflationary environment would provide a compelling case for a significant retreat in stock markets. Concerns surrounding technology companies' abilities to generate adequate profits from their investments are also increasing. A rift may reemerge between China and the United States, while Russia's unwillingness to end the armed conflict in Ukraine could lead to a rise in geopolitical risks.

Technically, on the daily chart, bulls have found strength to push prices above the pivot level of 6,750, which acts as support. As long as prices remain above this level, it makes sense to focus on buying.