The price of gold continues to hover near record highs as investors monitor the escalating tensions in Venezuela and await U.S. inflation data. Platinum also continued its rapid rally yesterday, increasing by 4%.

The price of the precious metal rose to $4,330 per ounce, up 0.8% on Wednesday. This is approximately $50 below the historical peak reached in October. The inflation data to be released today will be closely watched as it may provide insight into the Federal Reserve's willingness to implement further interest rate cuts.

The escalation of tensions between Venezuela and the U.S. is supporting gold prices. Geopolitical uncertainty is typically seen as a factor that boosts demand for safe-haven assets such as gold. Investors are concerned about potential destabilization in the region, which could lead to a shift in capital towards more secure instruments.

Despite the current resilience of gold prices, the near-term outlook remains uncertain. Much will depend on the Fed's further actions and the overall macroeconomic situation. If U.S. inflation proves more resilient than expected, the Fed may adopt a more cautious stance on interest rate cuts, putting pressure on gold prices.

At the same time, one should not rule out the possibility that further geopolitical risks will intensify. Any escalation of conflicts or the emergence of new tension hotspots could trigger a new wave of demand for safe-haven assets, supporting gold prices at high levels.

It is worth noting that this year, the price of gold has surged by nearly two-thirds and is likely to deliver its best annual performance since 1979, following a rapid increase driven by central bank purchases and investor outflows from government debt and key currencies.

Platinum has risen by 18% and continues to grow since the trading close on December 10. The increase has occurred amid signs of tightening conditions in the London market, where banks are relocating metals to the U.S. to hedge against the risk of tariffs.

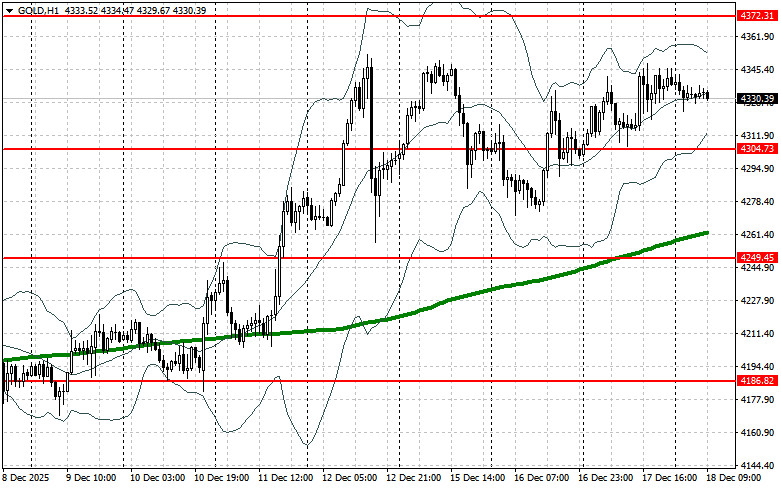

As for the current technical picture of gold, buyers need to reclaim the nearest resistance at $4,372. This will allow them to target $4,432, above which it will be quite difficult to break through. The furthest target will be around $4,481. In the event of a drop in gold prices, bears will attempt to take control of $4,304. If successful, a breakout below this range will deliver a severe blow to bullish positions and push gold down to a low of $4,249, with the potential to reach $4,186.