Nestlé (NSE:NEST) Nescafé plánuje do roku 2028 investovat dalších 500 milionů reais (88,7 milionů dolarů) v Brazílii, oznámila ve čtvrtek značka kávy na tiskové konferenci.

Tato částka je navíc k investici ve výši 1 miliardy realů, kterou společnost oznámila loni v největší ekonomice Latinské Ameriky.

Nové investice se podle společnosti zaměří na rozšíření továrny Montes Claros v jihovýchodním státě Minas Gerais a na zvýšení podílu kávovarů „Nestlé Professional“ na trhu.

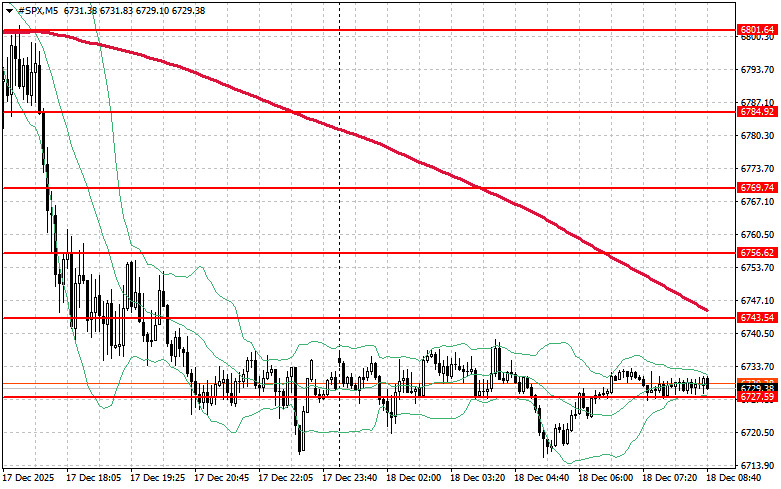

Yesterday, stock indices closed lower. The S&P 500 fell by 1.16%, and the Nasdaq 100 dropped by 1.41%. The Dow Jones Industrial Average declined by 0.87%.

Asian stock indices followed suit, reacting to losses in the US market as investors sold shares of technology companies amid concerns that their valuations had become excessive. Oil prices decreased after President Donald Trump, in a televised address, avoided escalating geopolitical tensions with Venezuela. This week, Washington imposed a blockade on tankers under sanctions from the South American country, with Trump accusing Caracas of depriving the United States of its "energy rights."

The regional MSCI index fell by 0.4%, with key indicators in South Korea and Japan dropping by approximately 1%. This occurred after Nvidia Corp. shares fell by 3.8%, reaching their lowest level since September.

The decline in technology stocks is yet another indication that investors are questioning the ability of companies leading the artificial intelligence boom to continue justifying their lofty valuations and ambitious investments. Concerns over the cost and feasibility of expanding data centers, such as Oracle Corp.'s funding plans in Michigan, have heightened overall apprehension regarding the sector's prospects.

Analysts are increasingly pondering the scalability of current AI models. Questions regarding the necessary computational power, the availability of skilled personnel, and, importantly, the ethical considerations surrounding AI use are becoming increasingly pressing. Some experts argue that the market is on the brink of a so-called "AI Winter," a period of declining interest in artificial intelligence characterized by disappointment over unmet expectations and insufficient profitability. Nevertheless, a complete abandonment of AI seems unlikely. Instead, a reevaluation of values and investments is expected, with a focus on more practical and profitable projects.

Against this backdrop, it is not surprising that in Japan, the largest losses were incurred by companies engaged in artificial intelligence. Shares of Lasertec Corp., Advantest Corp., and SoftBank Group Corp. fell by at least 3%. As noted earlier, Oracle's stock plummeted by over 5% in New York after the Financial Times reported that Blue Owl Capital Inc. withdrew support for a $10 billion deal to build a data center in Michigan.

Gold prices remain near record highs following a jump on Wednesday, as investors continue to search for alternatives to government bonds and currencies. The yield on shorter-term Treasury bonds has also risen.

Regarding the technical outlook for the S&P 500, the main task for buyers today will be to overcome the nearest resistance level of $6,743. Achieving this will indicate growth and open the possibility for a surge to a new level of $6,756. An equally critical task for bulls will be to establish control above the $6,769 mark, which would strengthen their positions. In the event of a downward movement amid declining risk appetite, buyers must make a stand around $6,727. A break below this level could quickly push the trading instrument back to $6,711 and pave the way down to $6,697.