(Reuters) – Americké ministerstvo spravedlnosti vyšetřuje, zda společnost Alphabet (NASDAQ:GOOGL) porušila antimonopolní zákon ve své dohodě se společností Character.AI, která technologickému gigantu umožňuje využívat technologii tohoto startupu zabývajícího se umělou inteligencí, informoval ve čtvrtek Bloomberg Law.

Antimonopolní úřady nedávno sdělily společnosti Google, že prověřují, zda dohoda se společností Character.AI nebyla uzavřena s cílem vyhnout se formálnímu přezkumu fúze ze strany vlády, uvedla zpráva s odvoláním na osoby obeznámené s touto záležitostí.

The recent labor market report failed to accurately gauge the health of the US economy. The flood of data from October and November was so contradictory that the S&P 500 experienced significant fluctuations. The delayed effects of mass layoffs among government employees contributed to this uncertainty, but the rise in the unemployment rate to 4.6% raised concerns.

Overall, there is a prevailing sense that the rate reductions in September, October, and December were appropriate, but the Fed now needs a pause to assess the impact of its previous actions. Excluding the federal workforce reductions, the average monthly nonfarm employment increased from 13,000 during the summer to 75,000 in the fall, indicating some warming in the labor market.

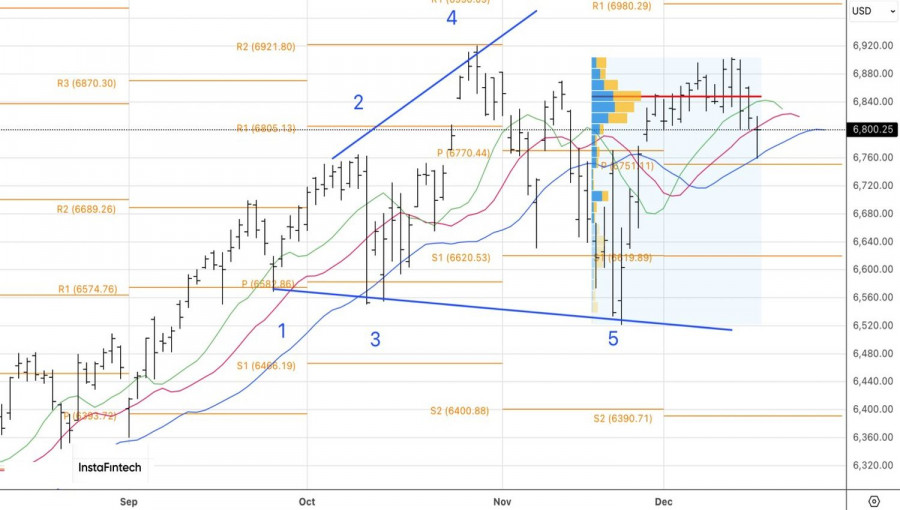

Market Index Dynamics

However, investors do not see signs of improvement in the US economy, particularly as business activity slowed in December and October retail sales did not grow. It is not surprising that the recent rotation of stocks within investment portfolios has reversed. The Dow Jones and S&P 500 indices have declined, while the NASDAQ 100 has risen.

Despite this, Wall Street experts are raising their estimates for corporate profits to +8.3% in the fourth quarter, projecting earnings of $310 per share by 2026. This translates to a 13% increase in profitability for the following year, providing hope for a continuation of the broad market rally, especially as analysts anticipate rising corporate profits in 2027.

Investors are looking forward with enthusiasm. According to a survey by Bank of America of global asset managers, their level of optimism is at the highest point since July 2021 when the US financial system was flooded with cheap liquidity to mitigate economic losses from the pandemic. The proportion of technology stocks in portfolios is at its peak since July 2024, while commodity stocks are at their highest since late 2022. The average cash level has dropped to 3.3%, which is another bullish signal for the S&P 500.

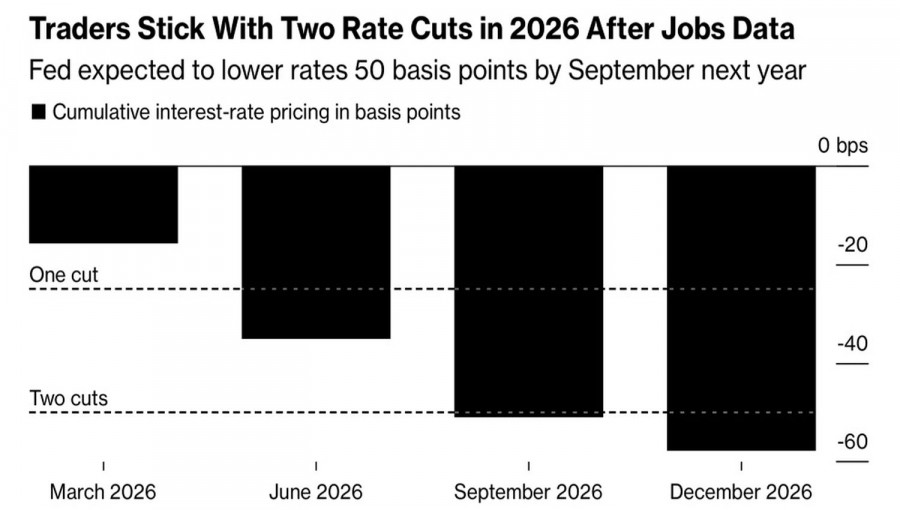

Expected Federal Reserve Monetary Expansion Dynamics

Thus, investors remain optimistic, anticipating at least two instances of monetary policy easing by the Fed in 2026 and are ready to return to technology stocks at any moment.

Furthermore, Morgan Stanley forecasts record levels of mergers and acquisitions in the sector next year, with deal sizes surpassing $1 trillion for the first time in history in 2025, driven by increased demand for artificial intelligence and its infrastructure.

Technically, on the daily chart, the S&P 500 is forming a doji candle with a long lower shadow. There is an opportunity to set a buy limit order near its high at 6,820. If activated, this could enhance the chances of a continued rally for the broad market index and a subsequent recovery in the upward trend.