Analysis of Trades and Trading Advice for the Euro

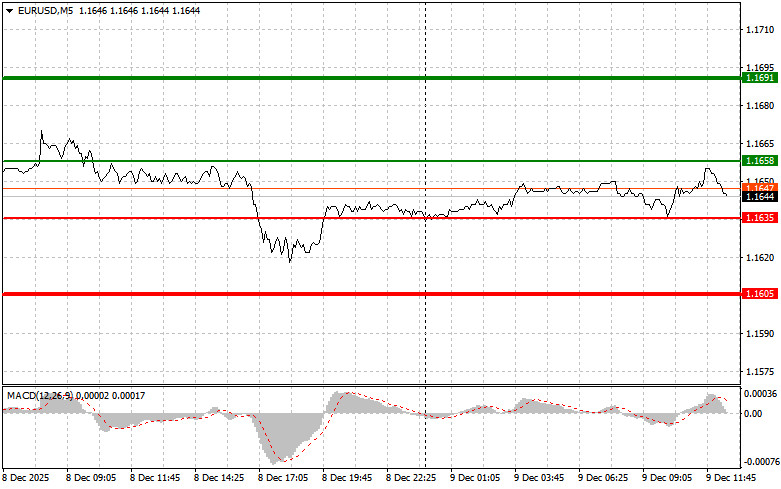

The first test of the 1.1640 price occurred when the MACD indicator had already moved far below the zero mark, which limited the pair's downward potential. For that reason, I did not sell the euro. The second test of 1.1640 coincided with the MACD being in the oversold area, which triggered Scenario #2 for buying euros and resulted in a 15-point rise — nearly the entire intraday volatility.

Positive German trade data supported the euro in the first half of the day, as the figures exceeded analysts' preliminary forecasts. According to Destatis, Germany's trade surplus increased in October, reflecting the stability of the German economy and its export capabilities.

Later today, market participants will focus on the U.S. NFIB Small Business Optimism Index. This indicator historically influences investor sentiment and serves as a leading signal for assessing the country's economic health. Also today, the weekly ADP employment change report will be published. The report shows the average change in U.S. private-sector employment over the past four weeks. These data are released weekly on Tuesdays, roughly two weeks after collection. The indicators are more volatile than the monthly ADP employment reports. Recall that weekly ADP reports began being published in October 2025. Higher-than-expected readings tend to support the U.S. dollar.

As for the intraday strategy, I will rely primarily on Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, you can buy the euro when the price reaches the level of 1.1658 (green line on the chart) with a target of rising to 1.1691. At 1.1691, I plan to exit the market, and also sell the euro in the opposite direction, expecting a 30–35-point move from the entry point. A strong rise in the euro can be expected after weak U.S. data. Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.1635 price at a moment when the MACD is in the oversold area. This will limit the pair's downward potential and lead to a reversal upward. You may expect a rise toward the opposite levels of 1.1658 and 1.1691.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches 1.1635 (red line on the chart). The target will be 1.1605, where I intend to exit the market and immediately buy in the opposite direction (expecting a 20–25-point rebound from that level). Pressure on the pair will return today if the data are strong. Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning to decline from it.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of 1.1658 while the MACD is in the overbought area. This will limit the pair's upward potential and lead to a reversal downward. A decline toward 1.1635 and 1.1605 can be expected.

Chart Notes

Important

Beginner Forex traders must be very cautious when making entry decisions. Before major fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you choose to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you ignore money management and trade large volumes.

And remember: to trade successfully, you must have a clear trading plan like the one provided above. Spontaneous decision-making based on the current market situation is inherently a losing strategy for an intraday trader.