LONDÝN/NEW YORK (Reuters) – Společnosti dovážející zboží do Spojených států z Číny se předhánějí v přeměně skladů na zařízení, která jsou osvobozena od cel zavedených prezidentem Donaldem Trumpem, dokud nebudou připravena zboží prodat.

USA mají více než 1 700 celních skladů, zařízení, kde lze dovážené zboží skladovat bez okamžitého zaplacení celních poplatků, jako jsou cla, která v současné době činí 30 % pro zásilky z Číny. Tyto poplatky se platí až při opuštění celního skladu, což podnikům umožňuje efektivněji spravovat finanční prostředky v době extrémní volatility obchodní politiky.

Spěch s převodem amerických skladů na sklady pod celním dohledem pro zboží od oděvů po automobilové díly je pro některé sázkou na to, že zvýšení cel ze strany americké vlády bude pouze krátkodobým opatřením.

Kvůli Trumpově celní válce je mnoho z těchto celních skladů nyní plně vytíženo a ceny za skladovací prostory v nich raketově vzrostly, uvedly čtyři zdroje z odvětví agentuře Reuters, což vedlo společnosti k podání žádostí u americké celní a hraniční ochrany o rozšíření celního prostoru.

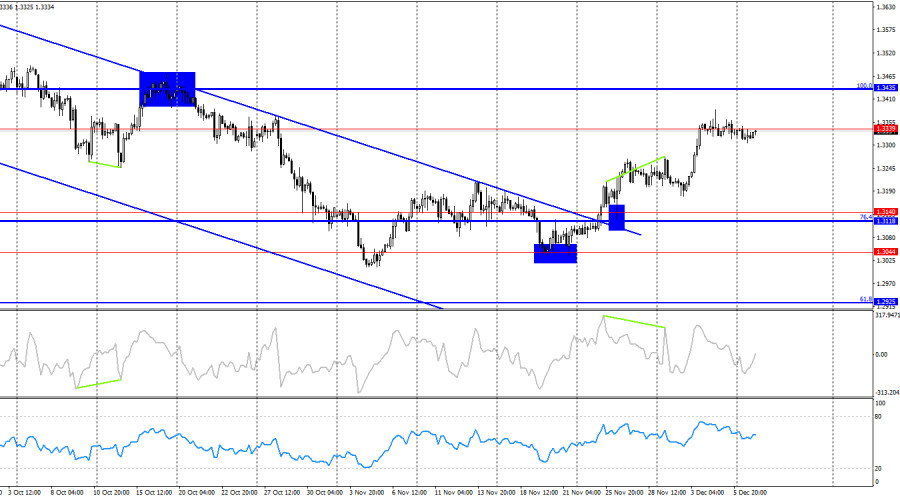

On the hourly chart, the GBP/USD pair on Monday continued a weak decline after two consecutive rebounds from the resistance level of 1.3352–1.3362, moving toward the 61.8% corrective level at 1.3294. A rebound from this level will work in favor of the pound and a return to the 1.3352–1.3362 level. A consolidation of the pair below 1.3294 will increase the chances of continued decline toward 1.3240, 1.3214, and 1.3186. Over the next two days, the news background may have priority.

The wave situation has shifted to a "bullish" one. The last completed downward wave did not break the previous low, while the new upward wave easily broke the previous high. Thus, the trend is currently "bullish." The news background for the pound has been weak in recent weeks, but the bears have fully priced it in, while the U.S. news background also leaves much to be desired. It is difficult for the bulls to continue their attacks, but their positions are currently better than those of the bears. The end of the "bullish" trend can only be confirmed below 1.3186.

The news background on Monday did not inspire most traders to trade, as there were no significant reports. However, this week marks the start of the U.S. statistical "hit parade," accompanied by meetings of the Fed and the Bank of England. I remind you that both central banks are expected to cut interest rates by 0.25%, but in the U.S. a series of important labor-market and inflation reports will also be released. I cannot say that there has been no movement in recent weeks. Rather, traders are more hesitant to deal with EUR/USD than with GBP/USD right now. Only in the past three days have market movements essentially stopped. However, I believe that starting today traders will begin drawing first conclusions about the state of the U.S. labor market, and tomorrow may bring many "New Year surprises." In my view, the pound and the bulls remain in a more convincing position. A "bullish" trend is forming, and the news background for the dollar is very weak.

On the 4-hour chart, the pair consolidated above the descending trend channel, above the 1.3118–1.3140 level, and rose to 1.3339. A rebound from this level will work in favor of the U.S. dollar and trigger a decline toward 1.3140. A consolidation above 1.3339 will allow expectations of further growth toward the 100.0% Fibonacci level at 1.3435. No new divergences are forming today.

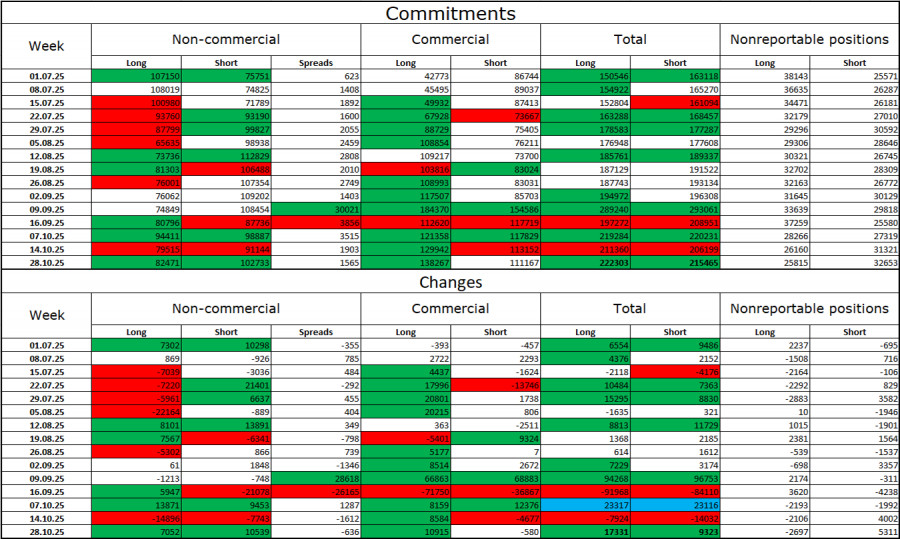

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category became less bullish in the latest reporting week, but that report is from one and a half months ago — October 28. The number of long positions held by speculators increased by 7,052, while short positions increased by 10,539. The gap between longs and shorts now is roughly 82,000 vs. 102,000. However, I remind you again that these figures are from mid-October. The picture may now be entirely different.

In my view, the pound still looks less "dangerous" than the dollar. In the short term, the U.S. currency enjoys some demand, but I believe this is temporary. Donald Trump's policies have led to a sharp deterioration in the labor market, and the Fed is forced to ease monetary policy to stop the rise in unemployment and stimulate job creation. Thus, while the Bank of England may cut rates one more time, the FOMC may continue easing throughout 2026. The dollar weakened significantly in 2025, and 2026 may be no better for it.

News calendar for the U.S. and the U.K.:

On December 9, the economic calendar contains two fairly interesting entries related to the U.S. labor market. The impact of the news background on market sentiment on Tuesday will be felt, but only in the second half of the day.

GBP/USD Forecast and Trader Recommendations:

Short positions could have been opened upon a rebound from the resistance level of 1.3352–1.3362 on the hourly chart with a target of 1.3294. These trades can remain open today. Long positions may be opened upon closing above the 1.3352–1.3362 level with a target of 1.3425, or upon a rebound from 1.3294.

Fibonacci grids are built from 1.3470–1.3010 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.