When the economy lacks arguments to hold back the bullish momentum of EUR/USD, politics steps in. The split within the Christian Democratic Union (CDU) has dealt a blow to the euro. About 18 party representatives do not support the pension project of the CDU and the Social Democrats. To pass it in the Bundestag, a majority is needed, and they are short by six votes. Chancellor Friedrich Merz's position has weakened, unsettling the main currency pair.

Politics and geopolitics have long impeded EUR/USD's progress. France has changed prime ministers as often as changing gloves, the armed conflict in Ukraine has lasted almost four years, and now Germany faces its own challenges. While I do not think a resolution is impossible, the mere emergence of this issue highlights the euro's Achilles' heel. Their presence prompts Reuters experts to set overly modest forecasts.

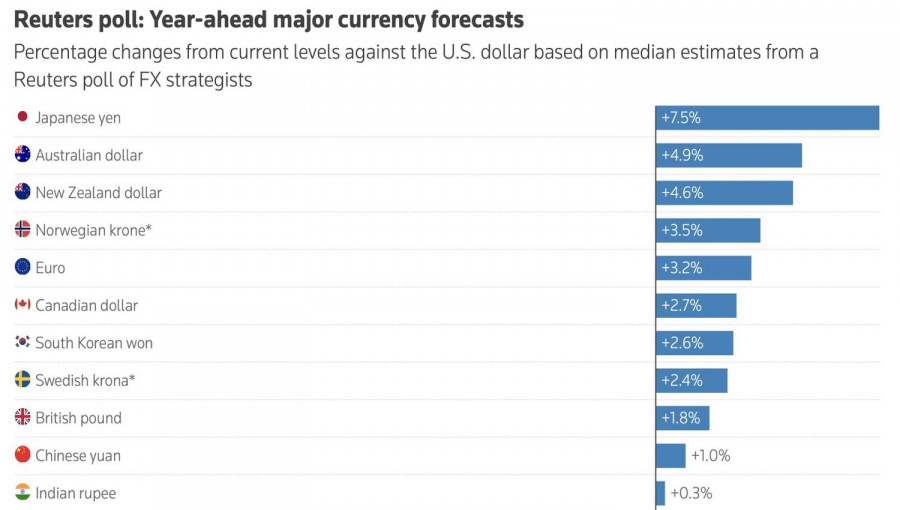

The consensus estimate from specialists surveyed by the popular publication suggests that in a month, EUR/USD will rise to 1.17, to 1.19 in three months, and to 1.20 in a year. Notably, if in November only 6% of respondents supported the idea of a short-term strengthening of the U.S. dollar, in December this figure rose to 30%. The main reason cited is Jerome Powell's "hawkish" rhetoric following the recent rate cut at the FOMC's 2025 meeting.

It is well-known that the composition of the Open Market Committee is deeply divided. The Federal Reserve Chairman needs to find a compromise between the "hawks" and the "doves." One option is to ease monetary policy while signaling that borrowing costs will be held steady for some time. A pause in the monetary expansion cycle will benefit the U.S. dollar.

However, it should be noted that the greenback's problems have not disappeared. Since the beginning of 2025, the USD index has declined by approximately 9% and is poised for its worst performance since 2017 amid tariff risks, a cooling U.S. labor market, financial issues, and doubts about the Fed's independence. While investments in artificial intelligence technology have helped mitigate the negative impact of tariffs on imports, the remaining challenges remain. According to data from Challenger, Gray & Christmas, companies plan to cut 71,300 jobs in November.

Interestingly, Reuters experts see the Japanese yen as a favorite for 2026, along with the Australian and New Zealand dollars. In their opinion, the main underperformers among the G10 currencies are the Swiss franc, the greenback, and the British pound.

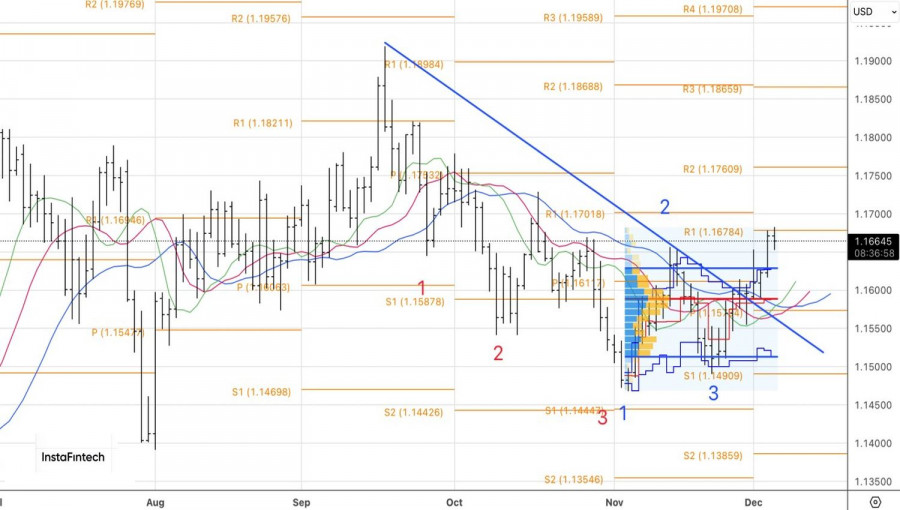

Technically, on the daily chart, EUR/USD is undergoing a retest of the 1.1675 resistance level. This is an important pivot level that has resisted the "bulls" during the previous two attempts. A breakout would allow for an increase in long positions, while a rejection would heighten consolidation risks.