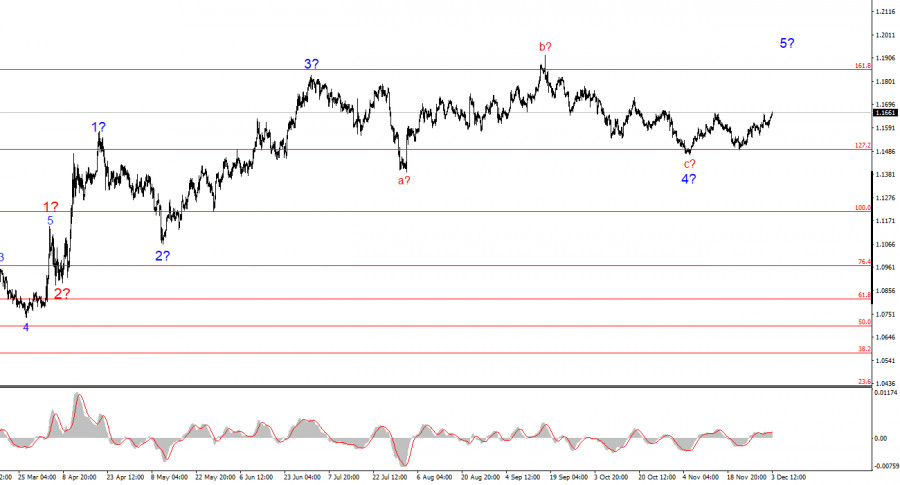

The wave pattern on the 4-hour chart for EUR/USD has changed, but overall it remains quite understandable. There is no talk of canceling the upward trend segment that began in January 2025, but the wave structure since July 1 has become significantly more complex and extended. In my view, the pair has completed the formation of corrective wave 4, which took on a very unconventional form. Inside this wave we observe exclusively corrective structures, so there is no doubt about the corrective nature of the decline.

In my opinion, the formation of the upward trend segment is not finished, and its targets extend up to the 1.25 level. The series of waves a-b-c-d-e looks complete, and therefore I expect the formation of a new upward wave sequence in the coming weeks. We have seen the presumed waves 1 and 2, and the pair is currently in the process of forming wave 3 or c. I expected the second wave to end in the 38.2%–61.8% Fibonacci level of the first wave, but the quotes fell to the 76.4% level. Over the past few days, everything has been proceeding as planned.

The EUR/USD pair gained about 40 basis points by the start of the U.S. session on Wednesday, which can be considered a "breakthrough." I remind you that yesterday two fairly important reports were released in the Eurozone, and the market ignored them completely. This morning the EU published reports that essentially no one needed and were not even marked as "important" in event calendars. These were the final Services PMI readings for Germany and the EU. It turned out that both indices came in slightly above market expectations, which theoretically could have triggered increased demand for the euro. The final readings were higher than the preliminary ones.

However, in my opinion, EUR/USD should be trading higher even without the support of secondary reports. The wave pattern continues to indicate the formation of a global upward trend segment and a short-term upward wave sequence. Therefore, under any news background, the European currency should continue rising. And if we recall that as early as next week the Federal Reserve is 90% likely to cut the interest rate for the third time, and in 2026 the new head of the organization is 90% likely to be Donald Trump's current economic advisor Kevin Hassett, it becomes clear that the dollar will find it extremely difficult to rely on market support. Personally, this has been obvious to me throughout 2025. Over the past few months, some market participants began abandoning the "sell the dollar under Trump" strategy, but I believe we witnessed only a temporary lull. The upward trend segment will continue forming.

Based on the analysis of EUR/USD, I conclude that the pair continues to build an upward trend segment. Over the past few months the market has paused, but Donald Trump's policies and the Federal Reserve remain powerful factors behind the potential future decline of the U.S. currency. The targets for the current trend segment may extend up to the 1.25 level. At this time the formation of an upward wave sequence may continue. I expect the formation of the third wave of this sequence from the current levels, which may be wave c or 3. At present I remain in long positions with targets in the 1.1670–1.1720 level.

On the smaller scale, the entire upward trend segment is visible. The wave pattern is not the most standard one, as the corrective waves differ in size. For example, the senior wave 2 is smaller than the internal wave 2 within wave 3. However, this also happens. I remind you that it is best to isolate clear structures on the charts rather than forcefully label every single wave. The upward structure currently raises no doubts.

Key Principles of My Analysis: