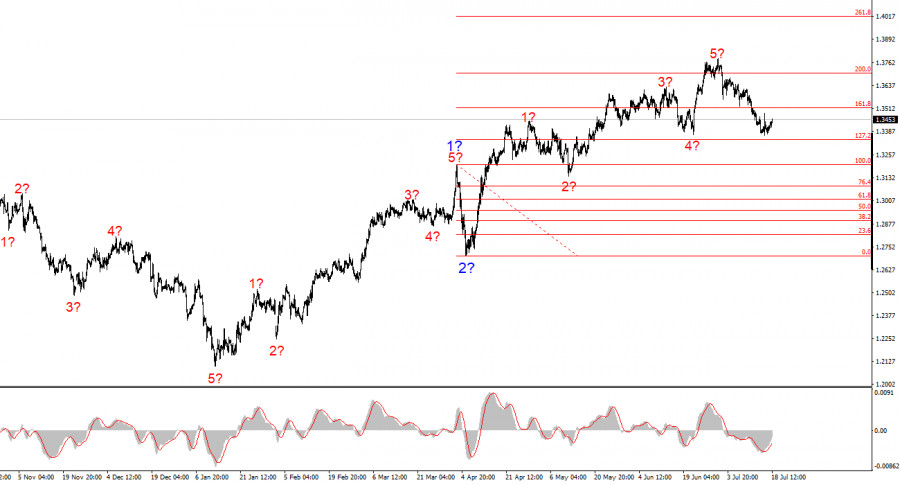

The wave pattern for GBP/USD continues to indicate the formation of a bullish impulse pattern. The wave picture is nearly identical to that of EUR/USD, as the sole driver of current market dynamics remains the U.S. dollar. Demand for the greenback is falling across the board, which is why many instruments are showing similar trends. Wave 2 of the upward trend took the form of a single wave. The presumed wave 3 has taken a convincing and completed form, so I expect a corrective structure to form next.

It's important to remember that much in the currency market right now depends on the policies of Donald Trump — not just in trade. From time to time, positive news comes out of the U.S., but the market remains overshadowed by uncertainty in economic policy, Trump's contradictory decisions and statements, and the White House's hostile and protectionist stance. Therefore, the dollar has to work hard to convert even good news into real demand.

The GBP/USD rate rose by 40 basis points on Friday, but significant changes may still occur by the end of the day. Market volatility is currently moderate. Sellers have recently pressured the pair, but not without difficulty. I have already noted that most of the truly important news out of the U.S. has not supported higher demand for the dollar. Even the latest inflation report — which triggered a notable dollar rally — had been correctly anticipated by the market in advance. If the data was already priced in, then on Wednesday, market participants had little reason to buy the dollar.

Similarly, there was no real reason to sell the dollar on Thursday. That day, Donald Trump launched a new round of accusations against Jerome Powell, but this time he began to raise the idea of Powell stepping down voluntarily. Powell and his administration are being "mildly accused" of excessive spending on Federal Reserve building renovations. But it's quite clear to everyone that Powell isn't solely responsible — he's not a construction manager, and the renovation budget was approved by the U.S. government back in 2021. By 2025, as Trump seeks Powell's removal, responsibility for past decisions is being placed on him.

What's interesting is that even this isn't working. Mr. Powell denies all accusations and has no intention of stepping down. Everyone in the market understands where this is coming from. Trump may ultimately succeed in forcing Powell out, but Powell only has nine months left in his term. With each passing month, the case for his removal becomes weaker. At the same time, every additional month of stagnation could cost the U.S. economy — and Trump personally — dearly. With high interest rates and a global trade war initiated by the U.S., the American economy is at serious risk of further slowing in Q2, Q3, and Q4. This is exactly why Trump urgently needs someone in the Fed who will lower rates. The longer it takes, the greater the risk of deeper economic deceleration.

The wave pattern of GBP/USD remains unchanged. We are dealing with a bullish, impulsive segment of the trend. Under Donald Trump, the markets may still face significant shocks and reversals that could seriously alter the wave picture. But at the moment, the working scenario remains intact. The targets of the upward trend segment are now located around 1.4017, which corresponds to 261.8% Fibonacci of the presumed global wave 2. A corrective wave sequence is currently unfolding. According to classic theory, it should consist of three waves.

Key Principles of My Analysis: