Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

Trade Review and Tips for Trading the British Pound

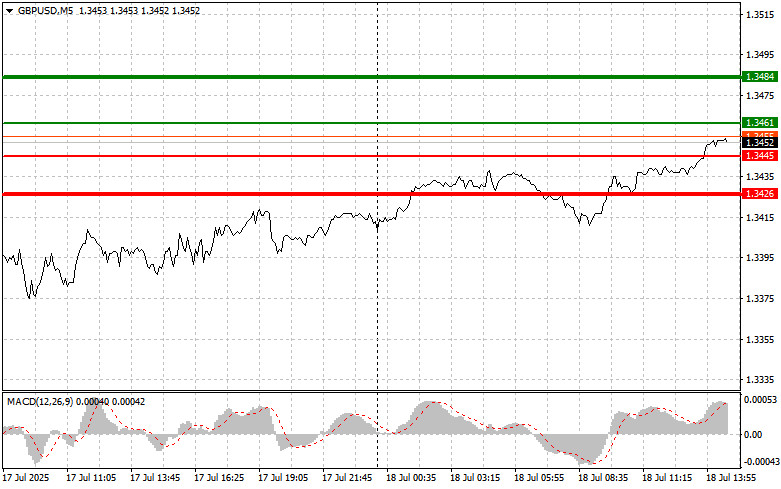

The test of the 1.3429 price level coincided with the MACD indicator just beginning to move upward from the zero line, confirming the correct entry point for buying the pound. As a result, the pair rose by more than 25 points.

The complete absence of UK data supported further gains for the pound. However, U.S. data on building permits and housing starts is still ahead. Weak data will further support the pound's growth, opening the way for the formation of a short-term upward trend, especially amid the lack of negative news from the UK side. These U.S. construction figures will be key today. A slowdown in this sector—reflected by a drop in permits and housing starts—may indicate growing economic challenges in the U.S., which would fuel discussions about the need for interest rate cuts. And as you know, that's bad for the U.S. dollar.

As for the intraday strategy, I will mostly rely on the implementation of scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the pound today upon reaching the entry point around 1.3461 (green line on the chart) with a target at 1.3484 (thicker green line on the chart). Around 1.3484, I will close long positions and open short positions in the opposite direction (expecting a 30–35 point move in the opposite direction). A stronger rise in the pound today can be expected if U.S. data is weak. Important: Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the pound today in case of two consecutive tests of the 1.3445 level, at a time when the MACD is in oversold territory. This would limit the pair's downward potential and trigger a reversal to the upside. Growth toward the opposing levels of 1.3461 and 1.3484 can then be expected.

Sell Signal

Scenario #1: I plan to sell the pound after the 1.3445 level is broken (red line on the chart), which should lead to a quick decline in the pair. The key target for sellers will be 1.3426, where I'll exit the short position and open a long position in the opposite direction (expecting a 20–25 point rebound). Sellers may return with pressure on the pair if U.S. data is strong. Important: Before selling, make sure the MACD indicator is below the zero line and just starting to fall from it.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.3461 level, at a time when the MACD is in overbought territory. This would limit the pair's upward potential and lead to a reversal to the downside. A drop toward the opposing levels of 1.3445 and 1.3426 can be expected.

Chart Legend:

Important: Beginner traders in the Forex market must be very cautious when deciding to enter a trade. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you could quickly lose your entire deposit—especially if you ignore money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one I've outlined above. Making spontaneous trading decisions based on current market conditions is a losing strategy for any intraday trader.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.