Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

The euro and the pound recovered slightly by the end of yesterday's session, as the U.S. dollar failed to receive significant support following the release of economic data and comments from Federal Reserve officials.

Yesterday's strong data on the growth of U.S. retail sales in June was largely ignored, and Fed officials' statements were quite mixed. As a result, there was no new interest in selling the euro and the pound at current lows. While improving economic prospects in the U.S. typically strengthen the dollar by making American assets more attractive to foreign investors, yesterday was an exception.

Today's focus will shift to the European economy. In the first half of the day, key data on Germany's Producer Price Index (PPI) is expected. This indicator is a primary measure of inflationary pressure in the manufacturing sector and could significantly influence the European Central Bank's policy. High PPI readings may raise concerns about persistent inflation and prompt the European Central Bank to take a more cautious stance on rate cuts.

Simultaneously, the ECB's current account balance report will be released. This figure illustrates the difference between incoming and outgoing payments in the euro area, serving as an important indicator of financial stability. A positive balance indicates capital inflows, which usually support the euro, while a negative balance may put pressure on the currency.

The first half of the day will conclude with a speech from Bundesbank President Joachim Nagel. His remarks will be especially significant given his recent statements in support of a more conservative approach to lowering interest rates.

If the data matches economists' expectations, it's best to follow a Mean Reversion strategy. If the data significantly exceeds or falls short of expectations, a Momentum strategy may be more appropriate.

Buying on a breakout above 1.1635 may lead to a rise toward 1.1660 and 1.1691

Selling on a breakout below 1.1600 may lead to a decline toward 1.1565 and 1.1511

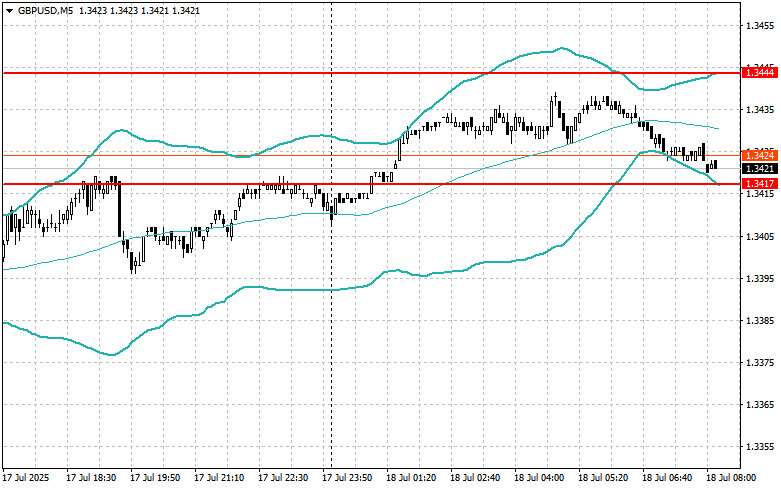

Buying on a breakout above 1.3430 may lead to a rise toward 1.3462 and 1.3500

Selling on a breakout below 1.3400 may lead to a decline toward 1.3365 and 1.3335

Buying on a breakout above 148.90 may lead to a rise toward 149.30 and 149.62

Selling on a breakout below 148.60 may lead to a decline toward 148.20 and 147.85

I will look to sell after a failed breakout above 1.1636 followed by a return below this level

I will look to buy after a failed breakout below 1.1610 followed by a return above this level

I will look to sell after a failed breakout above 1.3444 followed by a return below this level

I will look to buy after a failed breakout below 1.3417 followed by a return above this level

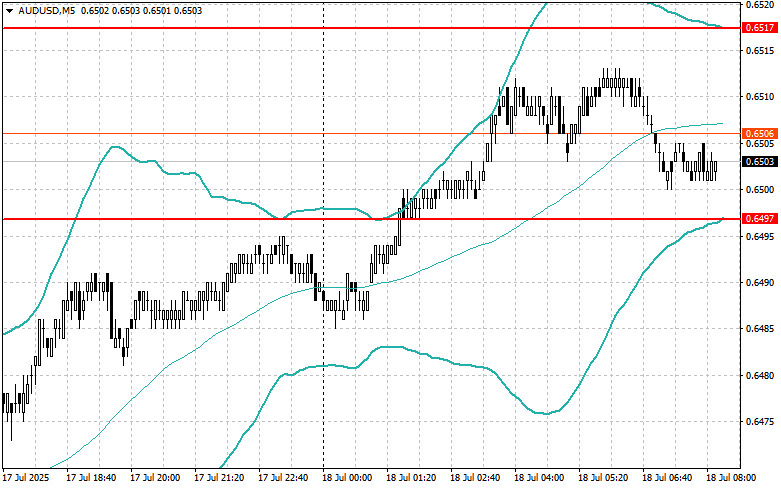

I will look to sell after a failed breakout above 0.6517 followed by a return below this level

I will look to buy after a failed breakout below 0.6497 followed by a return above this level

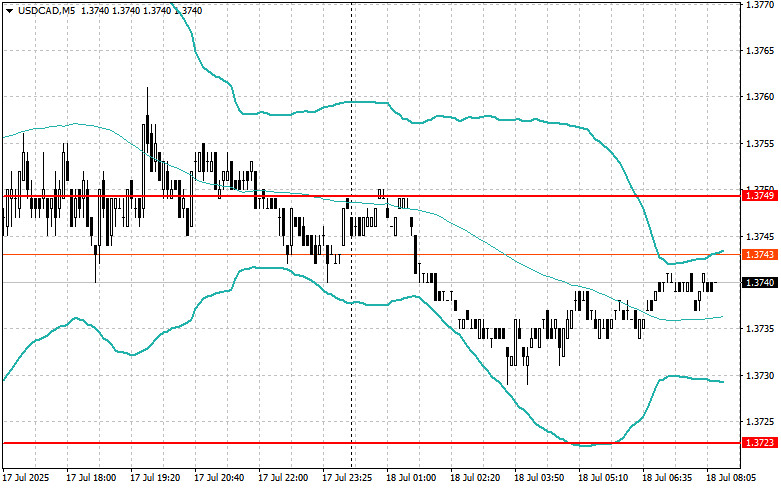

I will look to sell after a failed breakout above 1.3749 followed by a return below this level

I will look to buy after a failed breakout below 1.3723 followed by a return above this level

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.