The GBP/USD currency pair moved slightly higher on Friday, although the British pound had no real reason to grow that day or throughout the week. Let us recall that the three key events of the week that had any bearing on the pound and the dollar favored the latter. First, the Federal Reserve left monetary policy parameters unchanged and made no announcements regarding future easing. Second, the Bank of England cut its key interest rate and signaled its readiness to continue easing. Third, the UK and the US signed a trade agreement, which should also be seen as a positive for the US dollar. In short, the dollar had all the cards in its hand—but what can it do if the market still refuses to buy it?

In the EUR/USD article, we explained why the market avoids dollar purchases. However, at least the EUR/USD pair began a downward correction after three weeks of sideways movement, while the GBP/USD pair continues to trade purely sideways. The high point of recent years—1.3410—was reached on April 21. It's been three weeks since then. The current exchange rate of the British pound is 1.3300. In other words, the pair has "corrected" (if one can even call it that) by just 100 pips after a 1300-pip rally. This is neither a correction nor even a retracement. The market waits for developments in Donald Trump's tariff policy and keeps its finger on the "buy" button.

Yes, we've recently seen a "tariff lull," and Trump has even stopped firing Jerome Powell every other day. Now the U.S. president simply refers to Powell as a "slow-witted idiot," which seems to wrap up his attacks on the Fed. Traders understand that buying the dollar right now is like sticking your hand into a fire—you're guaranteed to get burned. So, no matter how solid the fundamentals and macroeconomic backdrop may be, the market does not want to buy the dollar at the moment.

For the U.S. currency to start rising, what's needed is a trade truce—and not with the UK, Serbia, Hungary, or Papua New Guinea, but with China, Canada, and the European Union. The U.S. and Trump personally are far from signing deals on their terms with these economic heavyweights. And that's another reason the dollar isn't growing. Even in the case of the euro, which has started a downward correction, we're not confident it will last even a week. And when it comes to the British pound, which has often shown remarkable resilience in recent years, it's even harder to expect a meaningful decline.

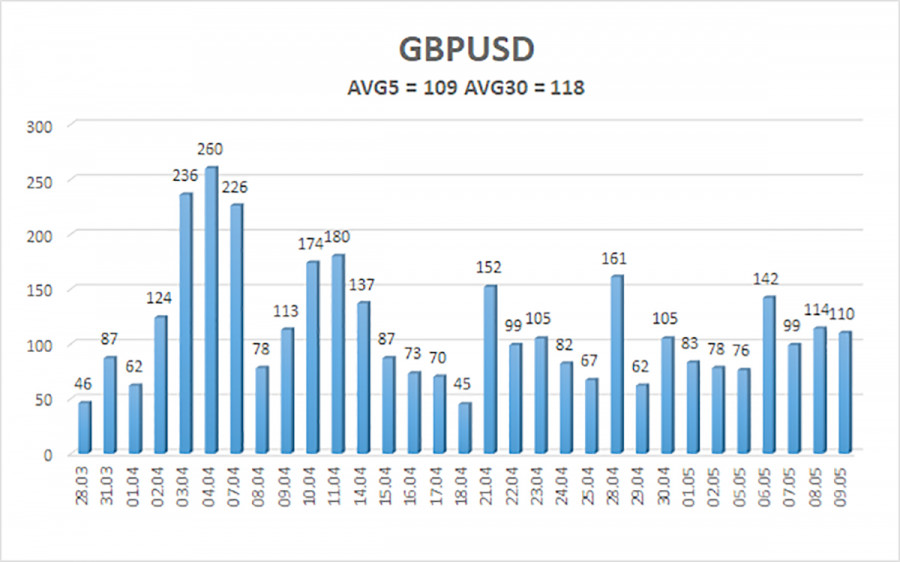

The average volatility of GBP/USD over the last five trading days is 109 pips, which is considered "average." On Monday, May 12, we expect movement within the range of 1.3191 to 1.3409. The long-term regression channel is pointing upward, indicating a clear upward trend. The CCI indicator has formed a bearish divergence, which triggered the latest decline, but that move has already ended.

S1 – 1.3184

S2 – 1.3062

S3 – 1.2939

R1 – 1.3306

R2 – 1.3428

R3 – 1.3550

The GBP/USD pair maintains an upward trend and has quickly completed its latest, weak corrective phase. We still believe there is no fundamental reason for the pound to rise. It's not that the pound is strengthening—it's that the dollar is falling, and it has been doing so for the past three months, primarily due to Trump. Therefore, Trump's actions could just as easily trigger a sharp decline or another upward surge.

If you're trading based on pure technical analysis or "on Trump," long positions remain relevant with a target of 1.3428, as long as the price remains above the moving average. Short positions also remain attractive: the initial targets are 1.3184 and 1.3165 if the price falls below the moving average. In recent weeks, the pair has been in a flat trend, making trades on the 4-hour timeframe pointless. In a flat, it's better to switch to lower timeframes.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.