The GBP/USD currency pair continued its upward movement on Monday. For most of the day, the price remained stable, but by the evening, the market unexpectedly began to buy the pound sterling again. Overall, the British currency has been rising continuously for the sixth consecutive day. We previously noted that last week, the pound did not have sufficient fundamental reasons to support such strong and persistent growth. Monday did not provide any further justification either. Therefore, we still view the current rise as somewhat illogical, given the local fundamental and macroeconomic context.

However, when we shift to the daily time frame, it becomes clear that the upward movement has technical justification. While this trend does not align with the current news flow (which is often often absent), a correction is both necessary and significant. In the near future, the price may break through the Ichimoku cloud. If this occurs, it won't be a major event, but the current rise of the British currency should be seen as a technical correction. This rise is stronger than that of the euro, which is expected, considering that the Bank of England adopts a more hawkish stance on monetary policy compared to the European Central Bank.

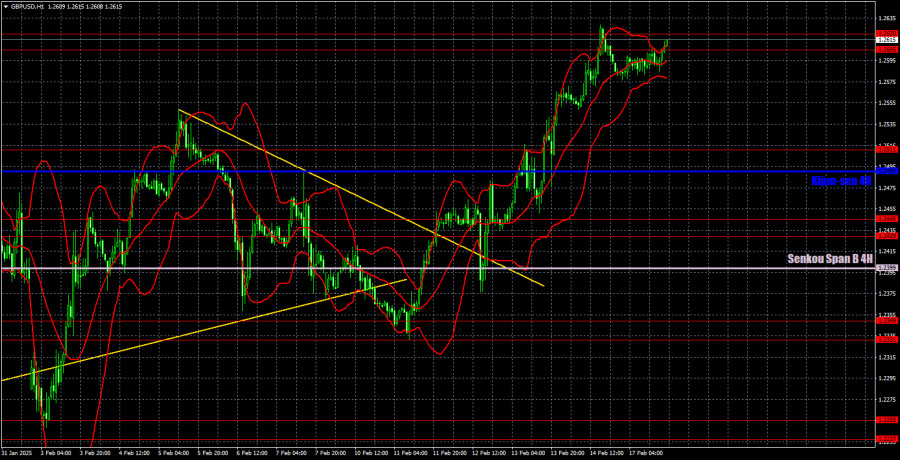

On Monday, there were no significant trading signals. As illustrated in the chart above, the pair mostly moved sideways with minimal volatility throughout the day, bouncing off the 1.2605 level several times. However, something triggered the unexpected rise of the pound in the evening, although this growth remained weak and, by that time, it was too late to open any positions.

The Commitments of Traders (COT) reports for the British pound indicate that sentiment among commercial traders has been consistently shifting over the past few years. The red and blue lines, which represent the net positions of commercial and non-commercial traders, frequently intersect and generally remain close to the zero level. Currently, these lines are near each other, suggesting that the number of buy and sell positions is almost equal.

On the weekly timeframe, the price initially broke through the 1.3154 level before dropping to the trendline, which it subsequently breached. This break of the trendline strongly suggests that the pound's decline is likely to continue. However, there was also a rebound from the previous local low on the weekly timeframe, indicating that the currency pair may be experiencing a flat.

According to the latest COT report, the Non-commercial group opened 3,600 buy contracts and closed 4,500 sell contracts, resulting in an increase of 8,100 in net positions. However, this shift does not provide any substantial support for the pound.

The fundamental backdrop still does not justify long-term purchases of the pound, and the currency has a real chance of continuing its global downtrend. As such, net positions may continue to decline, signaling a potential further drop in demand for the British pound.

In the hourly time frame, the GBP/USD pair is experiencing a new and uninterrupted uptrend. However, this may not be the final trend in a series of shifts. Currently, we do not see any fundamental reasons for the pound to increase in the long term. From a broader perspective on higher time frames, we do not recommend taking long positions. The pound's current strength appears to be only a result of a correction on the daily time frame, which we are witnessing at this moment.

For February 18, we identify the following key levels: 1.2052, 1.2109, 1.2237-1.2255, 1.2331-1.2349, 1.2429-1.2445, 1.2511, 1.2605-1.2620, 1.2691-1.2701, and 1.2796-1.2816. The Senkou Span B (1.2399) and Kijun-sen (1.2490) lines can also provide significant trading signals. It is advisable to place a stop loss at breakeven once the price moves 20 pips in the favorable direction. Keep in mind that the Ichimoku indicator lines may shift throughout the day, which should be taken into account when determining trading signals.

On Tuesday, important reports regarding unemployment and wages are set to be released in the UK. As always, the deviation of actual figures from forecasts will be critical. However, based on current projections, there appears to be little positive news for the pound. Therefore, it could rise again despite the negative macroeconomic context.