The EUR/USD currency pair continued its decline for most of Wednesday. In principle, almost every day, the article can be started with the same words because if a couple of weeks ago we often drew traders' attention to the almost daily fall of the euro, now this currency is updating its 20-year lows every day. Thus, if someone thought that the meetings of central banks were left behind and it was possible to breathe more freely for a while, he was mistaken. Recall that most factors that brought the euro currency so low continue to be relevant. And some are also increasing their pressure on risky assets. The market very cheerfully ignores the news and data that could provide hypothetical support for the euro currency. That is, we get a situation where there are plenty of reasons for the fall of the euro currency, and those factors that could provide support do not affect the mood of traders. Almost a stalemate. From the technical side, everything is also clear. We see strong downtrends on almost all timeframes. If some correction or rollback occurs from time to time on the smallest TF, then on the older TF, it is already as rare as the New Year. And what do we get in the end? The European currency is practically worthless and falling non-stop.

We have already said that if we try to take a sober look at the economic situation in the EU and the US, the picture turns out to be not so unambiguous in favor of the dollar. The recession has already begun in the US, and the Fed will not end its aggressive monetary approach. In the European Union, recent quarters have been positive, although GDP growth has been small. However, it was, so all the talk about the "energy recession," about the freezing of Europe this winter, the shutdown of many enterprises, and the popular revolt due to high prices for electricity and heat are just reflections, reasoning out loud. All this may be avoided. But again, the market does not even consider the hypothetical possibility that everything in Europe may not be so bad (we are not talking about some backward African country).

Christine Lagarde's speeches – the "hawkish" attitude persists.

The betting situation is also ambiguous. A few months ago, when the Fed was actively raising its rate and the ECB was impressively preparing for the first increase in 11 years, it was possible to understand why the euro currency was falling. But now, the ECB has already raised the rate twice and will actively and aggressively raise it at all the next meetings this year. That is, the gap between the rates, at least, has stopped growing. But the euro is still falling, and the dollar is still rising. European inflation is not higher than American inflation, but the euro is still falling, and the dollar is growing. What if, as a result, the Fed rate rises to 4.5% and the ECB rate rises to 4.25%, the European currency will fall indefinitely?

From our point of view, the main problem with the European currency is geopolitics. And not only the European currency. We are ready to repeat this daily because all other factors no longer look as significant as geopolitics. Maybe someone does not believe in a global war, but this option is allowed by the markets, investors, and traders. If geopolitical tensions increase, then market participants try to transfer their capital to the most stable and secure currency (or asset). That is why we see the endless growth of the dollar because now there is more talk about nuclear war (or a war between Russia and NATO) than any other news. What kind of mood should traders be in with such a background?

Moreover, the dollar is not just the world's reserve currency. The States (the issuer of the dollar) are located very far from the conflict. Everyone remembers that during the Second World War, the US economy practically did not suffer, so it had the opportunity to actively support its allies by providing them with weapons and equipment. The same thing can happen now. The European Union is too close to the war zone and may even accidentally become involved in the conflict (history has also seen such examples). In any case, it is in Europe that the military conflict is now. Therefore, Europe is suffering first of all.

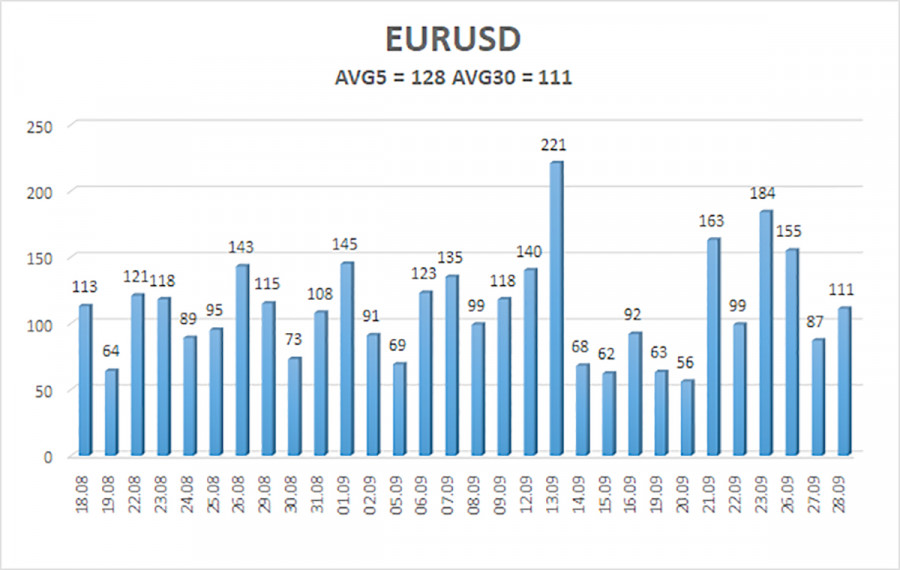

The average volatility of the euro/dollar currency pair over the last five trading days as of September 29 is 128 points and is characterized as "high." Thus, on Thursday, we expect the pair to move between 0.9525 and 0.9776 levels. The reversal of the Heiken Ashi indicator downwards signals the resumption of the downward movement.

Nearest support levels:

S1 – 0.9644

S2 – 0.9521

Nearest resistance levels:

R1 – 0.9766

R2 – 0.9888

R3 – 1.0010

Trading Recommendations:

The EUR/USD pair maintains a downward trend. Thus, new short positions should now be considered with a target of 0.9521 if the Heiken Ashi indicator is reversed. Purchases will become relevant no earlier than fixing the price above the moving average with a target of 0.9888.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

Moving average line (settings 20.0, smoothed) identifies the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator—its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.