There are relatively few macroeconomic reports scheduled for Monday. In the Eurozone, consumer price indices and unemployment rates will be released. These are important reports, but only unexpected and significant figures can provoke a reaction from traders. The European Central Bank has concluded its easing cycle with a 99% probability, so only a strong increase or decrease in inflation could prompt it to reconsider its rate plans. In the UK and the U.S., the calendars are practically empty.

Very few fundamental events are planned for Tuesday. Overnight, there was an expected speech from Federal Reserve Chair Jerome Powell, but as of now, there is no information about it, and market movements suggest Powell likely did not convey anything significant. Recall that the Fed meeting is scheduled for December 10, and currently, there is no vital information regarding inflation, the labor market, or unemployment. It is uncertain whether any pertinent information will arrive before December 10. Additionally, a speech from FOMC member Michelle Bowman, who has recently supported accommodative monetary policy, is expected.

Overall, the market is anticipating a third rate cut in 2025, but whether the Fed will take such a risk in the absence of labor-market and unemployment data is unclear.

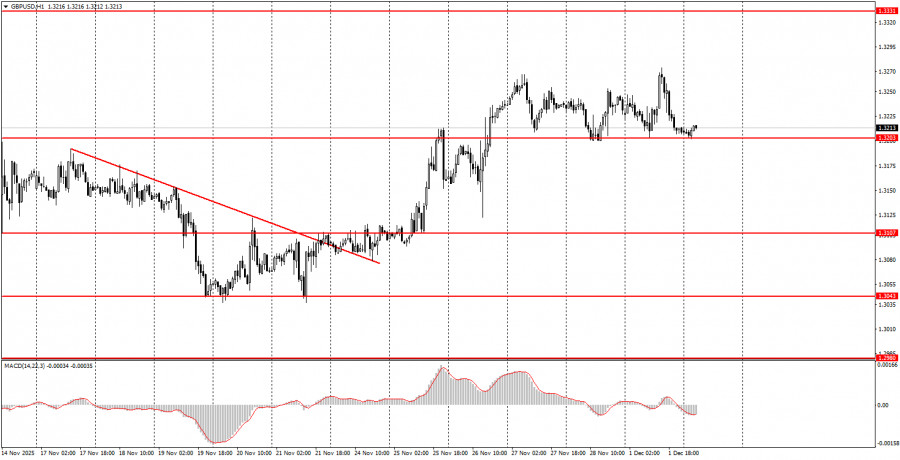

During the second trading day of the week, both currency pairs will trend toward growth, as a rising trend has begun in both cases. The euro has an excellent trading range at 1.1571-1.1584, where several buy signals have formed recently. The British pound has a range of 1.3203-1.3211 and is in a flat pattern. Volatility on Tuesday may remain low.

Important Note: Significant speeches and reports (always included in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their release, it is advisable to trade cautiously or exit the market to avoid sharp reversals against the preceding movement.

Remember: For beginners trading in the Forex market, it is crucial to understand that not every trade can be profitable. Developing a clear strategy and implementing sound money management are keys to successful long-term trading.

QUICK LINKS