The Japanese yen continues its confident intraday rise and has reached a two-week high against the weakening US dollar.

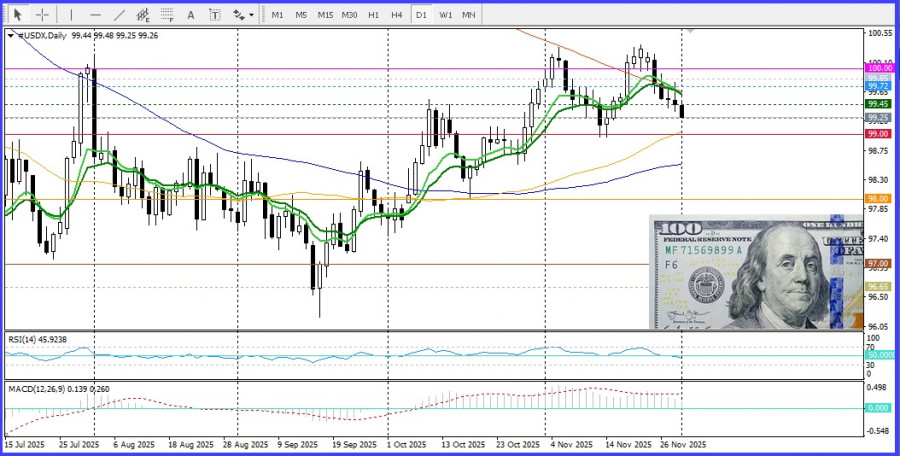

The Japanese yen continues its confident intraday rise and has reached a two-week high against the weakening US dollar. Bears in the USD/JPY pair are trying to accelerate the decline below the 155.40 area, which corresponds to the 100-period Simple Moving Average (SMA) on the 4-hour chart. Meanwhile, the oscillators on this same chart are in negative territory. However, it is worth noting that on the daily chart, they remain in positive territory. This suggests that the USD/JPY pair is not ready for a broad downward move and will likely find strong support near the psychological level of 155.00. Still, continued selling would confirm a breakdown, creating conditions for the weekly downtrend to resume.

On the other hand, any attempt at a significant recovery will face immediate resistance near the round level of 156.00. A move above this level could trigger a short-covering rally, pushing the price toward the 156.65–156.70 level. Above this zone, the USD/JPY pair could return to the round level of 157.00. This momentum may continue toward the intermediate level of 157.45–157.50, on the path to the multi-month high reached in November near the round level of 158.00.

QUICK LINKS