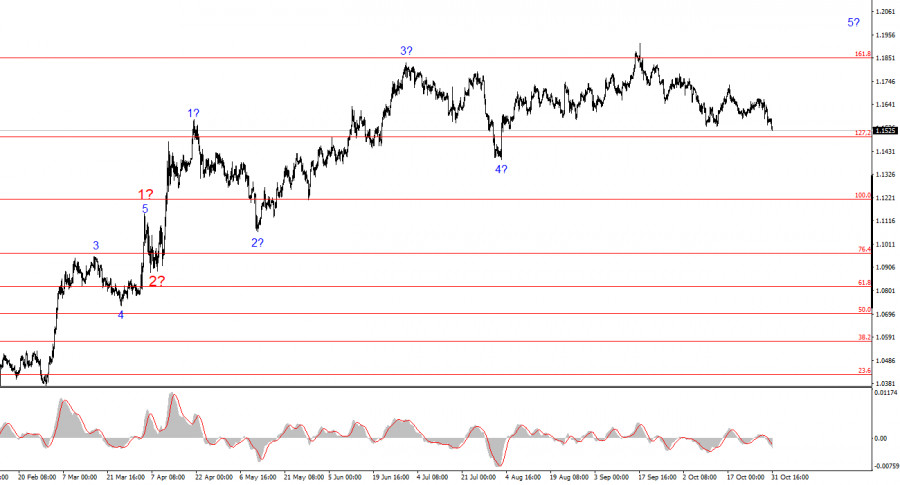

The wave pattern of the 4-hour chart for EUR/USD has changed — unfortunately, not for the better. It's still too early to conclude that the upward section of the trend has ended, but the latest decline in the euro has required an adjustment to the wave structure. We now see a series of corrective formations, which may form part of the global wave 4 of the broader upward trend. In this case, wave 4 has taken on an unusually extended form, but overall, the wave pattern still remains coherent.

The construction of the upward trend continues, while the news background overall continues to provide more support for the euro than for the dollar. The trade war initiated by Donald Trump persists. The president's confrontation with the Fed also continues. The market's "dovish" expectations for future rate cuts by the Fed remain high, especially looking ahead to 2026. Meanwhile, the U.S. government shutdown drags on, and the labor market is showing signs of cooling.

In my view, the upward trend segment has not yet completed, with targets potentially extending as high as the 1.25 level. Based on this, the euro may continue to decline for some time — even without strong fundamental reasons (as seen over the past month) — but the wave structure still points upward.

The EUR/USD rate dropped another 40 basis points on Friday. The euro has been falling almost all week, and by Friday, the situation had become far from amusing. Earlier, I suggested that the ECB may have begun covert currency interventions, as a stronger euro is extremely disadvantageous for the central bank. This is just a hypothesis, but how else can we explain the euro's decline and the dollar's rise?

Yesterday, the ECB concluded its penultimate meeting of the year and remained neutral in its decisions. Interest rates were left unchanged for the second consecutive time, while the Federal Reserve, in contrast, conducted a second round of monetary easing. Christine Lagarde stated that inflation is close to target, and the current monetary policy is appropriate and requires no adjustments. Consequently, a ninth round of easing is either postponed or canceled altogether.

If the ECB is no longer taking a dovish stance, then why is the euro falling? Inflation in the Eurozone slowed to 2.1% in October, but what difference does that make if Lagarde just said that no further easing is needed? Incidentally, the market had already expected inflation to slow to 2.1% year-on-year. Core inflation rose slightly to 2.4%, which theoretically should have prompted the ECB to consider raising rates. That factor alone should have supported the euro. In my opinion, the current decline in the European currency looks increasingly puzzling.

Based on the EUR/USD analysis, I conclude that the pair continues to build an upward section of the trend. The market is currently in a pause, but Trump's policies and the Federal Reserve's actions remain significant factors that could contribute to a future weakening of the U.S. dollar. The targets of the current trend may extend toward the 1.25 level. At present, we are likely witnessing the formation of a corrective wave 4, which has taken on a complex and extended shape. Therefore, in the near term, I continue to favor long positions, as any downward movements still appear to be corrective. The final a–b–c–d–e structure may be approaching completion.

At a smaller scale, the entire upward section of the trend is visible. The wave pattern is somewhat non-standard, as the corrective waves differ in size. For example, the larger wave 2 is smaller than the internal wave 2 within wave 3. However, such cases do occur. Let me remind you that it's better to identify clear, recognizable structures on charts rather than over-analyze every individual wave. The current upward pattern is, overall, quite clear.

Key Principles of My Analysis:

QUICK LINKS