The EUR/USD currency pair traded quite calmly on Tuesday. We have mentioned volatility in every article, as we believe it is currently a key factor. With any macroeconomic backdrop, fundamentals, or technical picture, if there are no market movements (or they are extremely weak), it is difficult to expect high profits from trades. The EUR/USD pair has been trading in a range for five consecutive months, as shown on the daily timeframe. We consider the range to be the second-most important factor in analyzing the pair's movements. Range + low volatility, what can we expect now?

The macroeconomic backdrop on Tuesday had the potential to provoke decent movements in the euro, but the market chose to ignore the reports on unemployment and inflation. As previously mentioned, the Consumer Price Index (CPI) in the Eurozone is currently of limited significance for the euro, as its value is almost equal to the European Central Bank's target level. Thus, the ECB has no reason to consider changing the monetary course. A slight increase in inflation for November is practically meaningless. Conversely, the unemployment rate, which rose to 6.4%, is also unlikely to be deemed a "failure." For example, in 2023, the unemployment rate in the Eurozone was 6.7%, and in October 2020, it was 8.4%. Therefore, in the long term, this indicator is declining and, over the past year, has fluctuated between 6.1% and 6.5%. Thus, there is no cause for alarm.

Essentially, the key event of the day was Donald Trump's announcement that he had chosen a new Federal Reserve chair. However, he did not name the president and intends to maintain a prolonged theatrical pause. Yet there is no real intrigue in this. Markets are confident that the new Fed chair will be Kevin Hassett, the current Trump advisor on economic matters. Traders also understand that it does not matter who the new Fed chair will be; it will be a person aligned with Trump, which means he will indeed follow the White House's directives.

Since Trump desires a significantly lower key interest rate, one can be certain that Hassett will support easing at every meeting, as Stephen Miran does now. The only question is how the "independent wing" of the Monetary Committee will behave. It should be recalled that most FOMC officials are concerned about new inflation rises and are not prepared to sacrifice one mandate (price stability) for another (full employment). At the moment, there are still more "hawks" than "doves." Therefore, Trump may need to fire one or two officials resistant to rate cuts to tilt the balance in favor of his agenda during monetary votes, or at least make an attempt to do so. However, in any case, the new Fed head will exert pressure on all the "hawks." Trump would criticize from the outside, while the new chair would act from within the Fed.

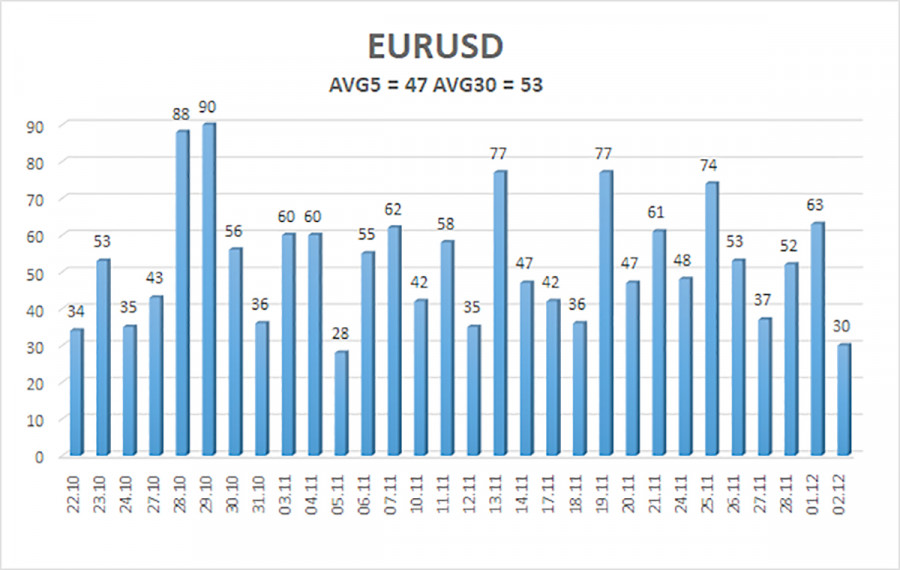

The average volatility of the EUR/USD currency pair over the last five trading days as of December 3 is 47 pips and is characterized as "medium-low." We expect the pair to trade between 1.1559 and 1.1653 on Wednesday. The upper linear regression channel is directed downward, indicating a bearish trend, but in reality, the pair continues to trade sideways on the daily timeframe. The CCI indicator entered the oversold area twice in October, which could trigger a new wave of the upward trend in 2025.

The EUR/USD pair remains below the moving average, but the upward trend persists across all higher timeframes, while the daily timeframe has been in a range for several months. The global fundamental backdrop remains immensely important for the market. We see that the dollar has recently been rising, but it has only moved within a sideways channel. For long-term growth, it lacks a fundamental basis. With the price below the moving average, small short positions can be considered, with targets at 1.1559 and 1.1536 based solely on technical grounds. Above the moving average, long positions remain relevant with a target of 1.1800 (the upper line of the range on the daily timeframe).

RYCHLÉ ODKAZY