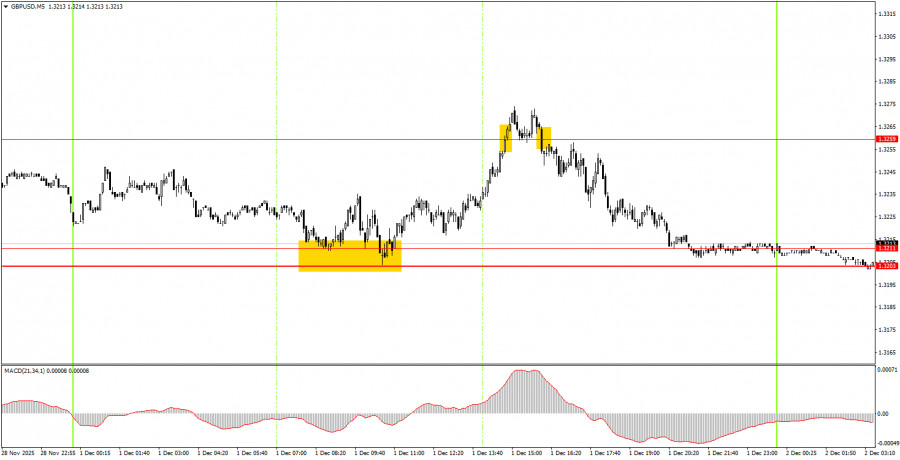

The GBP/USD pair showed no notable movements on Friday or Monday. On Monday, business activity indices for the manufacturing sectors in the UK and the US were released, but attention was primarily on the US ISM index. This index turned out to be weaker than forecasts and weaker than the previous month, yet after its release, the dollar still rose, as market participants likely had already priced in its negative value. Unfortunately, ordinary traders have little power against insider information available to some major players. Overall, the British pound has remained stagnant for three full days, caught in yet another flat. This time, the sideways channel can be characterized by the levels of 1.3203 and 1.3270. The upward trend still exists, but the British currency is making its gains very reluctantly, and volatility remains low.

On the hourly timeframe, the GBP/USD pair has begun to form a local upward trend, but it has quickly become stalled in another flat. As mentioned previously, no global fundamentals support a prolonged rise in the dollar, so we only expect upward movement in the medium term. The correction/flat on the daily timeframe may not be over yet, but any local trend on the hourly timeframe could signal a resumption of the global trend.

On Tuesday, novice traders may expect the formation of new trading signals in the area of 1.3203-1.3211, which can now be considered the lower boundary of the flat on the hourly timeframe. A bounce from this area will allow for new long positions with a target of 1.3259. A consolidation below this area will indicate short positions targeting 1.3096-1.3107.

On the 5-minute timeframe, levels to consider include 1.2913, 1.2980-1.2993, 1.3043, 1.3096-1.3107, 1.3203-1.3211, 1.3259, 1.3329-1.3331, 1.3413-1.3421, 1.3466-1.3475, 1.3529-1.3543, 1.3574-1.3590. On Tuesday, only two macroeconomic reports are scheduled, both in the Eurozone. Inflation for November will be released in its first estimate (the most important) along with the unemployment rate. We have already noted that inflation currently has little influence on trader sentiment, but it remains an important indicator for traders.

Important Note: Significant speeches and reports (always included in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their release, it is advisable to trade cautiously or exit the market to avoid sharp reversals against the preceding movement.

Remember: For beginners trading in the Forex market, it is important to understand that not every trade can be profitable. Developing a clear strategy and practicing money management are keys to long-term trading success.

RYCHLÉ ODKAZY